Over 40% of the total capital raised by FinTech companies in Denmark last year has been invested in Q1 2018 already

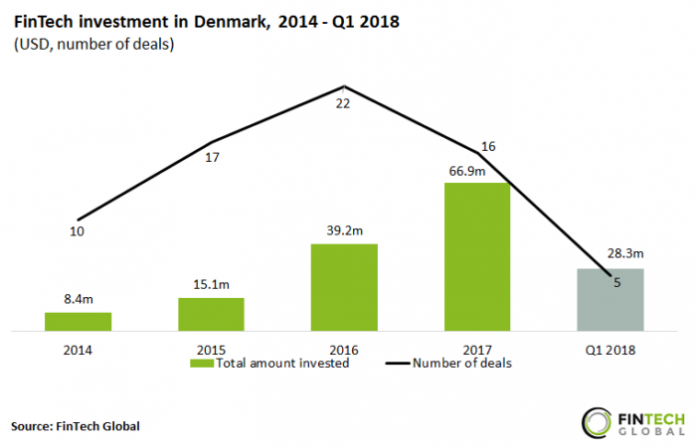

- More than $150m has been invested in Danish FinTech companies since 2014, with activity growing from 10 deals in 2014 to 16 last year.

- Deal activity peaked at 22 deals in 2016 when Danish FinTech companies raised almost $40m that year. Samlino, Denmark’s largest financial comparison site, raised $18.1m of venture funding in Q3 2016 which was the largest deal of the year.

- FinTech investment in Q1 2018 reached $28.3m and with strong efforts by the Danish government and Copenhagen FinTech (the country’s industry association) to boost the country’s FinTech ecosystem, more investment is expected to flow into the sector.

FinTech investment in Denmark has started the year strongly, with nearly $30m raised in Q1 2018

- FinTech deal activity in Denmark has remained quite stable over the past five quarters. LogPoint, a compliance management solutions provider, raised $10m in series B funding from Evolution Equity Partners, which was the largest deal in Q2 2017.

- More than 56% of the total capital invested in Danish FinTech companies in 2017 was raised in Q3. This was mainly driven by ViaBill, an e-commerce payment solutions provider, who raised $37.5m in October.

- Danish FinTech investment in Q1 2018 topped $28m, equating to 40% of the total capital raised by companies in the sector in 2017, setting strong funding expectations for the rest of the year.

Three of the largest 10 FinTech deals in Denmark over the last five quarters, took place in Q1 2018

- The top 10 FinTech deals in Denmark raised $92.3m over the last five quarters, with more than 30% of this funding coming from transactions completed in Q1 2018. Companies based in Copenhagen, the capital city and commercial hub of Denmark, attracted half of the country’s largest 10 deals since the start of 2017.

- OpenLedger, a cryptocurrency trading platform, raised $1.7m in seed funding from a group of Chinese, American and European investors in Q2 2017. This was the only crypto deal featured in the top 10 and the company used the seed capital to fund product development and partnerships with Chinese cryptocurrency exchanges.

- The largest deal was the previously mentioned $37.5m venture funding that ViaBill raised in Q3 2017. The company has signed up over 3,000 Danish e-commerce sites and will use the funding for product development and international expansion.

WealthTech companies have been involved in almost a quarter of all FinTech deals in Denmark since 2014

- WealthTech has been the best represented FinTech subsector in Denmark since 2014, with companies attracting just under 25% of all deals. Lunar Way, a mobile banking app, raised $5.1m in venture funding from Seed Capital and Nykredit A/S in Q2 2017. This is the largest Danish WealthTech deal to date, and funding has helped the company fuel growth in Northern Europe.

- Payments & Remittances companies have been involved in almost 16% of FinTech deals in the country since 2014, as companies adopt a digital-first approach to payment solutions. CardLab, a payment solution provider for online merchants, raised $6m in series A funding from Scentan Ventures in Q4 2015. The funding has helped the company accelerate its growth in Japan.

- Data & Analytics companies attracted 11.4% of FinTech deals in Denmark between 2014 and Q1 2018. Peakon, a big data analytics platform for HR departments, raised $22m in series B capital in Q1 2018, led by Balderton Capital. This is the largest deal in the subsector so far and the company, who counts BMW and Capgemini as clients, will use the funding to double down on its global expansion.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global