The FinTech sector saw nearly $9bn-worth of investment across 374 deals in Q2 2017 as the year funding picked up pace

- Overall FinTech funding grew by 50.8% to $8.9bn in Q2 2017 compared with the opening quarter of year, which closed at $5.9bn. This was despite an 8.6% fall in deal activity, down to 374 deals from 409 in Q1.

- During the three-quarter period of Q2 2016-Q4 2016 there was a continuous QoQ drop in total investment and deal activity. The was in part due to the political uncertainty happening in the US and the UK. This was then followed by a continuous QoQ rise of total investment as Q4 2016 total had more than doubled by the close of 2017 second quarter.

- Q2 2017 though still falls short of the totals that were seen in the second quarter of last year. There was a fall of 34.2% and 23.9% in total amount invested and deal activity, respectively.

- The largest deal in FinTech during Q2 2017 came for New Delhi-based One97 Communications, which raised $1.4bn back in May courtesy of SoftBank.

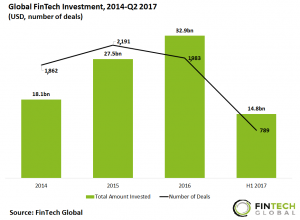

2017 looks set to fall short of 2016 record-breaking funding total with only $14.8bn invested in H1 2017

2017 so far has seen FinTech investments reach $14.8bn across 789 separate deals. These values are only 45% and 39.8% of the total seen last year, respectively, and therefore look set to fall short of what was a strong year for FinTech in 2016.

In the 2014-2016 period, there was a continuous YoY rise in total FinTech funding, with 2014 $18.1bn nearly having doubled at the close of 2016, which totalled $32.9bn.

2015 is FinTech most active year so far for deal activity. The first half of 2017 deal total is only 36% of what occurred in 2015.

Over a quarter of the FinTech investments each year since the start of 2014 have been received by either Payments & Remittances or Marketplace Lending companies

Payments & Remittances and Marketplace Lending combined share has exceeded a quarter of the total deal count on a yearly basis since 2014, as well as in the opening half of 2017. The share of deals going to the two subsectors has fluctuated from 26.1% in 2014 to 31.4% in 2014.

Infrastructure & Enterprise Software and WealthTech both saw modest upturns in their share of deals in the period, rising 4.6% and 5.8% in the period, respectively.

The share of deals going to Other subsectors in FinTech i.e. Blockchain, Cryptocurrencies, and RegTech, fell by 3.4% in the period from 15.3% in 2014 to 11.9% at the close of the opening half of 2017.

The largest deals in the period to come from Payments & Remittances and Marketplace Lending are ANT Financial massive $4.5bn Series B round from 2016 and a $1bn Series C round in San Francisco-based SoFi from 2015, respectively.

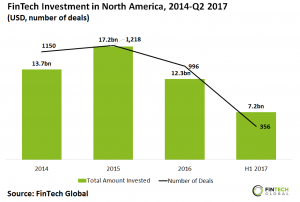

North America leads the way for FinTech investments in H1 2017 with $7.1bn, but Europe and Asia are on the rise after a strong 2016

North American FinTech funding fell by over a quarter in 2016 compared with 2015, along with deal activity which also fell by 18.2%.

North America is the leading region for global FinTech investments. North American FinTech companies received 55.1% of the funding rounds the sector has seen since the start of 2014 an amount equivalent to 3,720 deals.

The largest deal in H1 2017 that went to a North America-based company was another funding round that went Online Loan company SoFi. In February, they raised a $500m Series F round led by Silver Lake Partners.

The largest FinTech investment in North America in the period was received by Atlanta-based First Data Corporation, which raised a $3.5bn round in mid-2014 in the form of private equity. The round sole investor was KKR & Co. (Kohlberg Kravis Roberts & Co.).

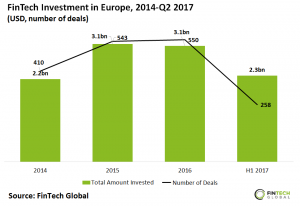

- European FinTech deal activity rose YoY in the period 2014-2016 by 34.1%

- 2017 looks set to be a record year for total FinTech investment in Europe. The $2.3bn already invested surpasses the $2.2bn seen in 2014, and is over two-thirds of 2015 and 2016 figures.

- Europe is the second largest region in global FinTech behind North America, having received 26.1% of the overall deals in FinTech since the start of 2014 equivalent to 1,761 deals.

- Banking Infrastructure company Avaloq raised the largest European FinTech funding round of H1 2017. They received $353m (3.5m Fr.) in private equity from London-based investor Warburg Pincus in late-March.

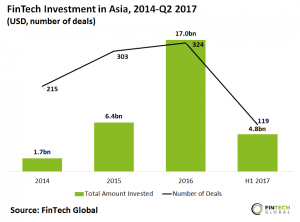

- Asia saw a continuous YoY rise in both total funding and deal activity in the 2014-2016 three-year period.

- Asia, seen as the up-and-coming hub of FinTech, has seen 14.2% of the deals in FinTech since the start of 2014 equivalent to 961 deals Asian investment will have to increase in the latter half of the year in order to match 2016 figures.

- Asian, European, and North American deals count for over 95% of FinTech investments since 2014. The remaining 4.6% of FinTech investments went to either Africa, Australasia, or the Middle East & Israel.

- H1 2017 largest deal that went to an Asia-based FinTech company was One97 Communication $1.4bn round from mid-May the round was the largest FinTech investment of the period.

- The largest deal to go to an Asia-based FinTech company in the 2014-Q2 2017 period was the previously mentioned Series B funding round that went to ANT Financial – the largest investment in a FinTech company to date.

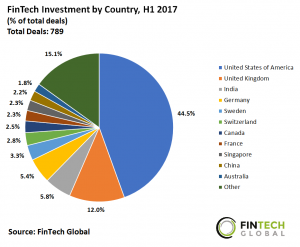

Over 40% of the FinTech investments in H1 2017 went to US-based companies, while the UK received more than 10%

- US-based FinTech companies have received more than 40% of the funding round to the FinTech sector since the start of 2017. With 44.5% of the deals equivalent to 351 deals the US is shown to be the central hub for global FinTech.

- The UK is the closest single challenger to the US dominance in deal activity, having received 12.0% to transactions, the equivalent to 95 deals.

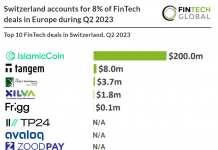

- Each of the nations featured a FinTech ecosystem that received 10 or more funding rounds in the period, with India, Germany, Sweden, and Switzerland all receiving an excess of 20 each. FinTech companies based in more than 40 countries received funding in the opening half of the year.