The FCA reminds banks that not all their employees need to be at the...

The Financial Conduct Authority (FCA) has told banks, building societies and credit unions that they need to carefully consider which of their workers should be able to work remotely in order to deal with COVID-19 appropriately.

ASIC’s loosens up Australian investment rules to help businesses tackle the coronavirus

The Australian Securities & Investments Commission (ASIC) has taken steps to ensure the health of the Australian market during the COVID-19 pandemic.

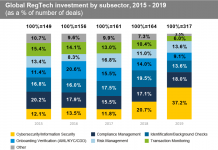

Last year’s jump in global RegTech activity was driven by increased investment in cybersecurity...

Cybersecurity companies continue to be leading the growth of the global RegTech sector when it comes to investment.

18 FinTech funding rounds you missed last week

Despite coronavirus fears, the last week saw a number of FinTech companies raise money.

MAP FinTech launches new Market Abuse Trade Surveillance Solution on its Polaris platform

RegTech company MAP FinTech has unveiled its latest offering to help businesses comply with market abuse regulations.

Austrian financial regulator FMA prohibits short-selling of certain financial instruments because of the coronavirus

The markets are volatile due to the coronavirus. The Austrian Financial Market Authority (FMA) has banned some short-selling to prevent the situation from getting even worse.

The FCA tells banks to stay open

The UK went on lockdown on Monday March 23. Still, the UK's top financial watchdog is advising that banks remain open.

The FCA wants businesses to hold off publishing their financial statements because of the...

Many financial services firms have been gearing up to publish their financial statements. But now the UK’s financial markets watchdog tells them to wait for at least two weeks.

What can RegTech companies learn from the coronavirus outbreak?

While the COVID-19 pandemic is causing a lot of damage on the financial sector, there are also lessons to pick up from it.

FDIC gives Square conditional permission to open a bank

Square is one step closer to launching its bank in 2021 after the Federal Deposit Insurance Corporation (FDIC) board voted to conditionally approve the FinTech’s application for deposit insurance for its Industrial Loan Company bank charter.