Akur8, renowned for its next-generation InsurTech pricing and reserving solutions, has teamed up with Utica First, a leader in small business and personal lines insurance.

FinTech News

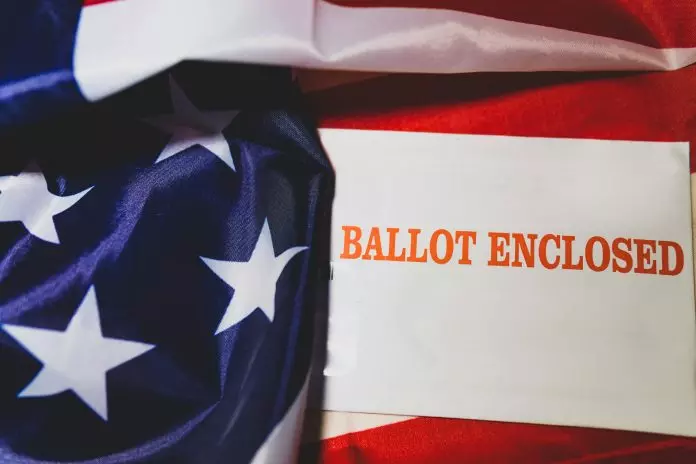

The 2024 U.S. presidential election, one of the most closely watched and contentious in recent history, has culminated in Donald Trump’s re-election as the 47th president. With the nation sharply divided over key issues—from economic policies and immigration to the future of democracy—this election has underscored the deepening polarisation in the U.S. political landscape. As ballots are counted and legal challenges loom, the country stands at a critical juncture, with Trump poised to once again shape the future of America amidst intense scrutiny and ongoing controversies. But what does this historic moment mean for the global InsurTech industry?

As the insurance industry rapidly modernises, actuaries are becoming integral in shaping and executing strategic growth plans. With a focus on enhancing risk management, leveraging advanced technologies like AI, and optimising decision-making processes, actuaries are driving innovation across the landscape. Their expertise is crucial in adapting to industry changes and achieving long-term business objectives, underscoring their pivotal role in the future of insurance strategy.

In today’s rapidly changing insurance sector, the focus on managing the human side of risk has never been more important. Insurance now extends beyond policies and claims—it is about fostering a culture of safety, building long-term trust, and enhancing collaboration […]

Chubb, a leading global insurance provider, has launched a new product to cater to high-net-worth individuals in Switzerland.

The insurance sector is a dynamic market that continuously evolves due to technology, policyholder demands, and legislation. To stay competitive and provide optimal service, insurers must adapt to these changes. Comarch, a global IT business products provider, explores several trends shaping the insurance claims landscape.

Akur8, a next-generation insurance pricing solution, has announced that Millennial Specialty Insurance (MSI) will leverage its innovative offering to streamline the decision-making processes within its pricing team.

In the competitive landscape of insurance underwriting, the integration of risk data is emerging as a secret weapon to enhance the performance of your underwriting team. One way this can be exploited is through the use of loss control, a risk management method aimed at decreasing the likelihood of losses occurring and minimising the impact of any that do happen. Due to the clear benefits of this, numerous key industry players are now claiming that advanced loss control practices can transform the traditional underwriting processes, reducing claims while increasing renewals and premiums.

Insurtech UK has published its Roadmap of recommendations for policy-makers to retain and strengthen the UK’s leading global status in insurance innovation. The plan, which was released at the end of June, outlines how the next government can create a supportive […]

Insurance is an industry where every pathway converges towards the customer. When developing policy offerings, it’s crucial to consider the client, including features such as online quote generation and purchasing options for auto and homeowners insurance. The convenience of obtaining these policies online has become essential for satisfying customers and capturing market share. Global IT business products provider Comarch dives into how you can satisfy your digital insurance clients.

About FinTech Global

FinTech Global is the world’s leading provider of FinTech information services, B2B media products and industry events.

We serve a network of over 300,000 FinTech professionals to provide them with essential business information and help them connect with potential investors, clients and partners.

Contact Us

Follow Us