Akur8, renowned for its next-generation InsurTech pricing and reserving solutions, has teamed up with Utica First, a leader in small business and personal lines insurance.

InsurTech

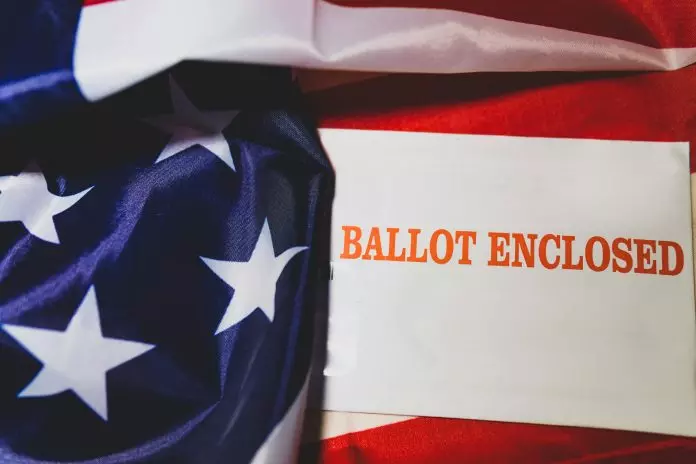

The 2024 U.S. presidential election, one of the most closely watched and contentious in recent history, has culminated in Donald Trump’s re-election as the 47th president. With the nation sharply divided over key issues—from economic policies and immigration to the future of democracy—this election has underscored the deepening polarisation in the U.S. political landscape. As ballots are counted and legal challenges loom, the country stands at a critical juncture, with Trump poised to once again shape the future of America amidst intense scrutiny and ongoing controversies. But what does this historic moment mean for the global InsurTech industry?

Akur8, the next-generation insurance pricing and reserving platform, has been selected by RSM to enhance its insurance pricing process.

Markel, a global specialty insurer, has launched a cutting-edge cyber insurance policy designed to cater to FinTech firms.

As the insurance industry rapidly modernises, actuaries are becoming integral in shaping and executing strategic growth plans. With a focus on enhancing risk management, leveraging advanced technologies like AI, and optimising decision-making processes, actuaries are driving innovation across the landscape. Their expertise is crucial in adapting to industry changes and achieving long-term business objectives, underscoring their pivotal role in the future of insurance strategy.

In today’s rapidly changing insurance sector, the focus on managing the human side of risk has never been more important. Insurance now extends beyond policies and claims—it is about fostering a culture of safety, building long-term trust, and enhancing collaboration […]

Chubb, a leading global insurance provider, has launched a new product to cater to high-net-worth individuals in Switzerland.

Simplifai has partnered with Stillwater Insurance to automate its claims process, aiming to enhance customer service and operational efficiency.

As we step into the second half of 2024, the InsurTech landscape is poised for significant advancement. Emerging technologies such as AI, machine learning, and large language models are set to revolutionise risk assessment, underwriting, and customer experiences. Meanwhile, there is a growing emphasis on ESG considerations bubbling up under the surface.

Carbon Underwriting Limited, a specialist and independent managing general underwriter, announces the launch of its second syndicate, Syndicate 5757, following approval from Lloyd’s. The firm, known for its expertise as a managing general underwriter and operating Lloyd’s syndicate CBN 4747, is […]

About FinTech Global

FinTech Global is the world’s leading provider of FinTech information services, B2B media products and industry events.

We serve a network of over 300,000 FinTech professionals to provide them with essential business information and help them connect with potential investors, clients and partners.

Contact Us

Follow Us