Global RegTech investments in companies addressing MiFID II surpassed $100m in 2017

Global investment in regulatory technology (RegTech) companies that address MiFID II totalled $378.5 million between 2013 and 2017 according to research from FinTech Global, in the run up to MiFID II implementation on 3rd January 2018.

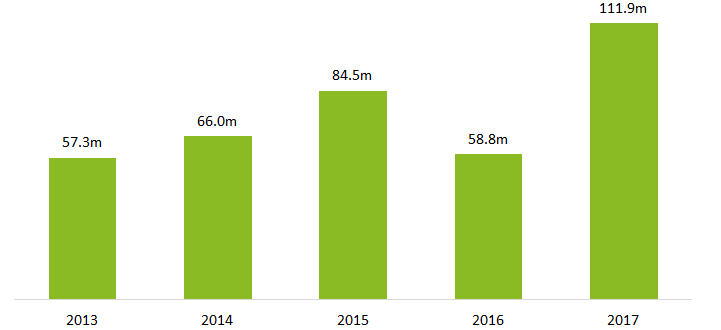

MiFID II RegTech investments nearly doubled last year

Capital invested in RegTech companies addressing MiFID II globally increased at a CAGR of 18.2% between 2013 and 2017, reaching a total of $378.5 million. This equates to 9.5% of the total investment in RegTech companies during the same period. The largest RegTech investment in a MiFID II solution provider between 2013 and 2017 was the $75 million private equity investment Dublin-based Fenergo raised in Q3 2015, led by Aquiline Capital Partners and Insight Venture Partners.

Investments jumped from $58.8 million in 2016 to $111.9 million in 2017, driven by larger deals, as end users readied themselves for MiFID II implementation at the start of 2018. This increase of 90.2% in funding last year raised the share of total RegTech funding going to MiFID II solution providers from 10.4% in 2016 to 14.9% in 2017. The largest investment in a company addressing MiFID II last year was MetricStream’s $65 million venture round, led by Clearlake Capital Group in Q4 2017.

MiFID II solution providers are garnering greater interest across the RegTech landscape

RegTech companies that address AML and KYC dominate the RegTech universe. This is understandable given the increasingly complex requirements placed and heavy fines imposed for inadequate compliance by regulatory authorities.

MiFID II has been one of the most significant pieces of legislation to impact financial markets in recent times and, consequently, is now the third most commonly addressed regulatory framework by RegTech companies.

Although MiFID II solution providers raised 9.5% of the total capital invested in RegTech companies since 2013, they represent 15.9% of companies in the RegTech universe. This is because many established RegTech companies have now also added MiFID II solutions to their existing product suite, in order to address demand from existing clients.

In line with the increased attention to the provision of MiFID II solutions, we are now also seeing M&A activity in this space. An example of this is New York-based Visible Alpha’s acquisition of London-based MiFID II solution provider Alpha Exchange in Q4 2017, with the aim of creating an end-to-end solution for research management.

MiFID II regulation has also been driving activity outside of the core RegTech ecosystem. For example, Deutsche Börse and Illuminate Financial Management recently co-led a $5 million Series A funding round in RegTek Solutions, a multi-jurisdiction regulatory reporting provider. RegTek Solutions’ software will form part of Deutsche Börse’s new Regulatory Reporting Hub — a compliance division set up to help customers follow market rules such as those enforced by MiFID II.