Only 40% of the total capital raised by InsurTech companies in 2017 came from deals over $100m, compared to 62% in 2015

- Investments in InsurTech fell by almost 20% YoY in 2016 after a total of $1.9bn was invested in the space in 2015. Despite this the investment in deals valued under $100m increased by 21.7% last year accompanied by an increase in deal activity.

- The total funding coming from deals valued over $100m has fallen since 2015 when 1.2bn was invested in deals within this bracket. This particularly large figure was mainly due to a $937m deal to Chinese InsurTech giant ZongAn.

- Between 2014 and 2016 the number of InsurTech deals had a compound annual growth rate of 30% reaching a high of 201 deals in 2016. However, the first three quarters of this year have seen a slowdown in the number of deals closed with only 68.2% of 2016’s total completed.

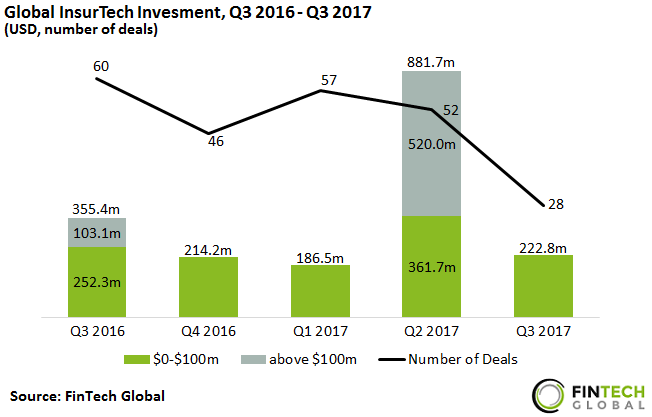

InsurTech deal activity slumped to a five-quarter low in Q3

- Q3 2017 saw the number of InsurTech deals fall to a five-quarter low of 28, continuing the gradual decline in deal activity since 57 transaction were completed in the first quarter of this year.

- So far, this year there have been three deals valued above $100m. These were all closed in Q2 2017, driving up the total investment for that quarter. Gryphon Insurance, the UK based digital insurance challenger, received $230m in June, making it the largest InsurTech deal so far this year. The other two deals went to US-based Bright Health and Clover Health which raised $160m and $130m, respectively. Q2 2017 was also a strong quarter for deals valued under $100m with $361.7m invested.

- Q3 2017 saw total funding levels fall by 37.3% YoY to $222.8m. The quarter also saw less than half the number of deals invested in Q3 2016.

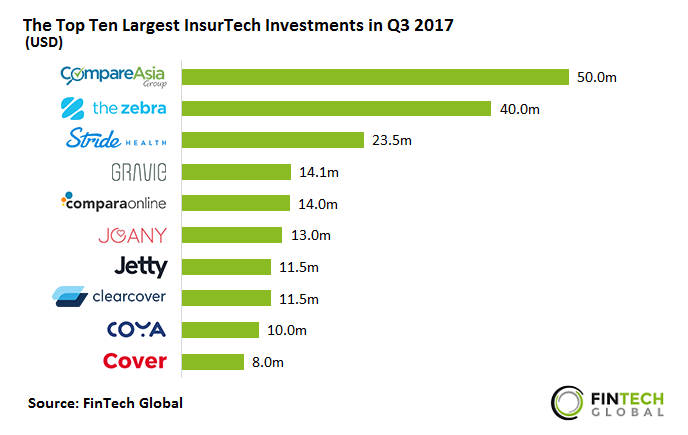

The Top 10 InsurTech deals in Q3 2017 received a total of $195.6m, almost 90% of the total investment for the quarter

- The comparison website CompareAsiaGroup raised $50m in the largest round of this year’s third quarter. This equated to more than 20% of the total InsurTech investment in that period. The round saw participation from IFC, Goldman Sachs and Alibaba Entrepreneurs Fund. According to reports ComparaAsiaGroup will use the money to hire new talent and improve the user experience.

- The top two investments went to companies developing comparison websites. Stride Health raised the largest round to a core InsurTech company. The San Francisco-based company received $23.5m in Series B funding from F-Prime Capital Partners, Venrock, New Enterprise Associates and Portag3 Ventures in August.

- Seven of the largest deals in Q3 2017 went to companies based in the USA with the remaining three deals going to Berlin-based Coya, Chile-based ComparaOnline and Hong Kong-based CompareAsiaGroup.

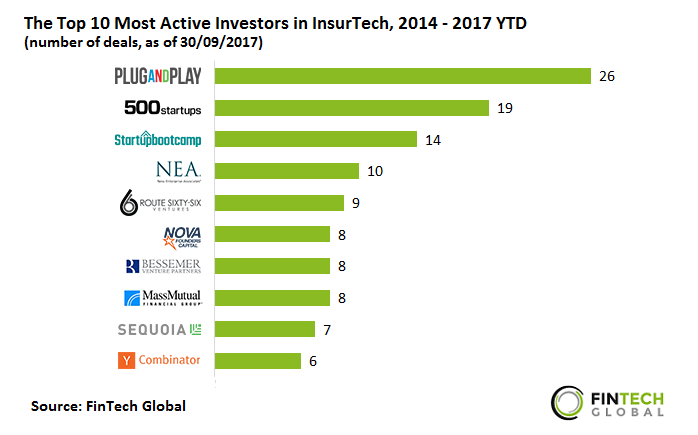

The top 10 most active investors participated in 19.8% of all deals closed since 2014

- Plug and Play, the most active investor in InsurTech made 26 investments between 2014 and Q3 2017. Thus, the firm participated in almost 5% of deals closed in this period.

- The top three most active investors; Plug and Play, 500 Startups and Starupbootcamp are all accelerators. These firms participated in almost 60 deals to InsurTech companies between 2014 and Q3 2017. Plug and Play and Startupbootcamp also run dedicated InsurTech accelerators.

- Eight of the top ten most active investors are based in the US with the remaining two; Startupbootcamp and Nova Founders Capital based in the UK and Hong Kong, respectively.