Global WealthTech funding is on track to surpass 2017’s record with over $2bn invested in Q1 2018

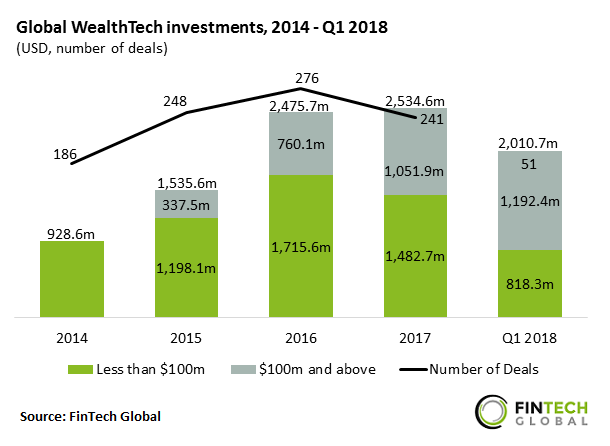

- Investments in WealthTech companies increased from $928.6m in 2014 to $2.5bn in 2017 at a CAGR of 28.5%.

- This upwards trend is on track to continue in 2018. Capital invested in Q1 reached $2bn which equates to 79.3% of last year’s total. Almost 60% of this funding came from six later-stage deals valued $100m and above. There were eight such deals closed during the whole of 2017.

- Despite the comparatively high investment total, deal activity is slightly behind pace compared to last year’s. The 51 deals in Q1 represent 21.2% of the total number of deals completed in 2017.

Global WealthTech investments rocketed in Q1 2018 to set a new funding record

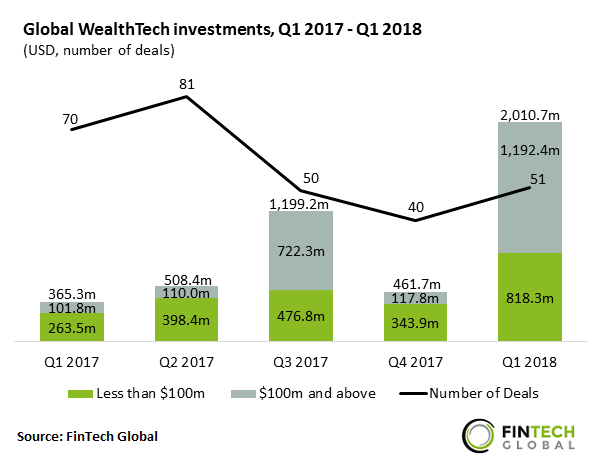

- More than $2bn was invested in the global WealthTech industry in Q1 2018 making it the strongest funding quarter to date. This represents an increase of 5.5x compared to the same quarter last year.

- The largest WealthTech deal in Q1 2018 was a $500m secondary investment in Credit Karma, a credit and financial management platform, from Silver Lake Partners. As a result of the investment, Credit Karma benefited from a 23% increase in valuation, making it worth approximately $4bn.

- In contrast with the jump in total investment, deal activity was historically mid-range with 51 deals completed.

Accelerators top the list of most active investors in WealthTech

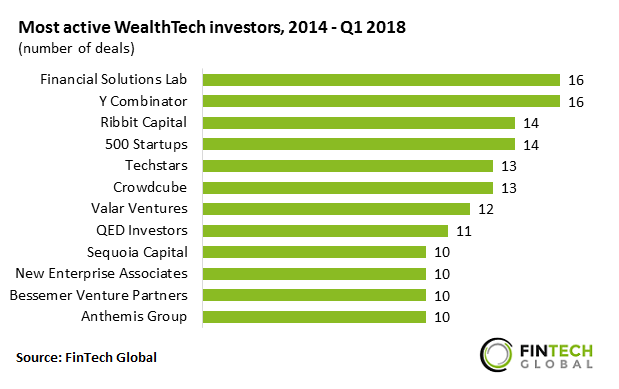

- Two accelerators, Financial Solutions Lab and Y Combinator, were joint top investors in WealthTech between 2014 and Q1 2018 with 16 deals each. Financial Solutions Lab is a five-year initiative, managed by the Centre for Financial Services Innovation with JP Morgan, which supports FinTech companies that help to improve financial health in the United States.

- Another seed accelerator and early-stage venture fund, 500 Startups, followed in joint second place beside Ribbit Capital with 14 investments each.

- All venture capital firms on the list are based in the United States with the exception of Anthemis Group which is headquartered in London. Its portfolio contains several established UK-based WealthTech companies including Atom Bank, Tide and Monese.

The top ten WealthTech deals in Q1 2018 raised $1.5bn

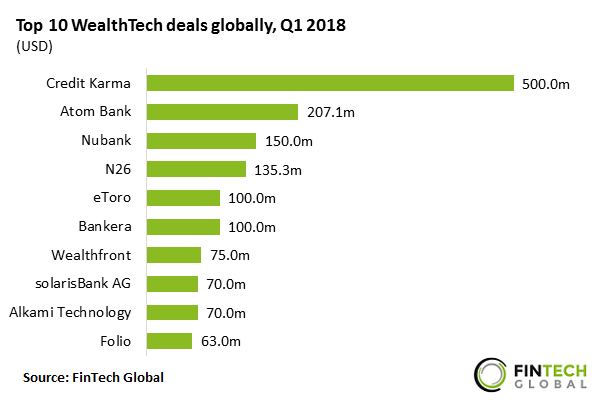

- The combined total of the top ten WealthTech deals in Q1 2018 reached almost $1.5bn, equating to 73.1% of the overall amount invested in the quarter.

- Six of the top ten investments were raised by companies offering Online Banking solutions, three of which are challenger banks: Atom Bank, Nubank and N26.

- The only investment in a company based outside of North America or Europe went to Nubank, a Brazil-based challenger bank. The $150m Series E round was led by DST Global with co-investment from Thrive Capital and Ribbit Capital, among others. The funding will be used to further support the company’s growth and expansion.