LoanLogics, which looks to improve the transparency and accuracy of the mortgage process and improve the quality of loans, has raised $10m in funding.

The round of funding was led by Blue Cloud Ventures, with participation from existing investors, including Volition Capital. Back in December 2015, the company collected $11.2m from Volition.

Founded in 2004, LoanLogics serves the needs of residential mortgage lenders, servicers, insurers, and investors that want to improve loan quality, performance and reliability throughout the loan lifecycle. It helps clients validate compliance, improve profitability, and manage risk during the manufacture, sale and servicing of loan assets.

It plans to use the new funds to support its continued growth, expansion of origination technologies and increase research and development.

Lenders are continuing to face more demands on their time from regulators and the ‘stakes of non-compliance are greater than ever’ according to Mir Arif, general partner of Blue Cloud Ventures.

Roger Hurwitz, managing partner of Volition, added: “Regulators continue to focus much of their attention on establishing regulations designed to ensure loan quality. Lenders require a way to stay compliant and that requires automation to process loans with the confidence that issues will be flagged and resolved well before the loan closes and across the entire loan life cycle.”

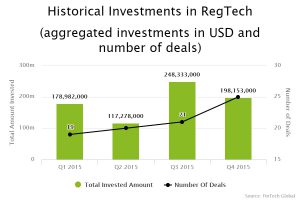

Last year, there was more-than $742.74m invested across the global RegTech sector according to data by FinTech Global. The final quarter of the year was the busiest for 2015, with 25 deals completed. However, the most capital was invested in Q3, with $248.33m spread across 21 deals.

Copyright © 2017 FinTech Global