California-based mobile banking platform Chime has netted a $18m Series B funding round led by Cathay Innovation.

Other contributions to the round came from new backers Northwestern Mutual Future Ventures and Omidyar Network. Several existing investors also took part including Crosslink Capital, Aspect Ventures, Forerunner Ventures and Homebrew.

Mobile banking platform Chime provides users with a spending account, savings account, debit card, and an app which helps manage all of their financial processes. The platform, which has no monthly fees, helps with automatic savings, fund transfers between accounts, and access to more than 24,000 free ATMs and 30,000 cash-backed banks.

Since its launch in 2014, the platform has had over 500,000 bank accounts opened.

This new round of equity will help the company accelerate its growth and develop new products to help improve financial lives of customers. Alongside this, the capital will be used to launch new features which will automate various financial processes, with new services through its open APIs and partnerships to help keep a client’s accounts fully connected and easily managed.

Cathay Innovation co-founder and CEO Denis Barrier said, “Chime members engage with the app every day and trust Chime as the deposit account for their paycheck. It’s much more than just a mobile app. With triple digit growth in new bank account openings in the last year, Chime has emerged as the clear leader in the US challenger banking segment.”

This investment brings total funding by the company to around $36m, with the firm picking up a $9m funding round last year led by Aspect Ventures.

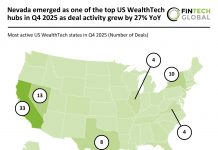

North American WealthTech investments received the highest number of funding in the last quarter, compared to any other region.

Copyright © 2017 FinTech Global