Wave, a business financial management (BFM) solutions provider, will integrate its invoicing, accounting, and business financial insights technology into Royal Bank of Canada’s online banking platform.

The offering will enable RBC’s small business clients to manage their full business financial services’ needs , from banking and bookkeeping to invoicing, in a single place with a single sign-on.

Toronto-based Wave delivers cloud-based financial management software with seamlessly integrated financial services to business owners around the world. Nearly three million business owners around the world have used Wave to help manage their finances, and 70,000 new businesses join the Wave ecosystem every month.

RBC’s new interface will give owners insights into their business by combining their banking and accounting information under one view, which will help them make more informed decisions according to the bank.

Business owners can leverage Wave’s suite of services, like invoicing in virtually any currency, automated billing, and the ability to digitally manage receipts and track expenses.

Jason Storsley, vice-president of small nosiness at RBC, said: “We’re always exploring how we can use emerging technologies to simplify the complex issues our small business clients face and help them achieve their goals.

“Small businesses generally don’t have dedicated accounting and billing staff; it’s typically the owner of the business who is managing the finances, and completing these tasks takes up valuable time. Working with Wave, we’ve created a unique platform where the business owner’s financial life is contained under one roof, making it easier for them to manage their business. This means a small business owner can spend more time being the CEO of their business and less time being the CFO.”

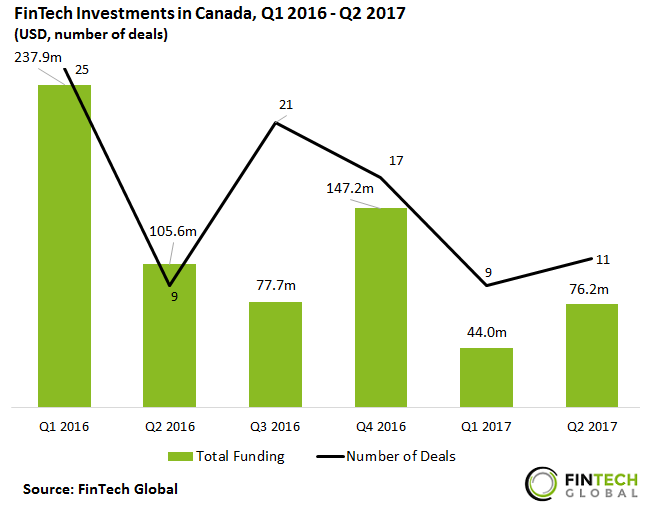

FinTech Investments in Canada increased in Q2 2017 after a disappointing start to the yea according to data by FinTech Global.

Total FinTech investments rose in Q2 2017 compared with Q1, but failed to match the levels set last year. FinTech companies in Canada received only $76.2m in Q2 2017 – a 27.8 per cent decrease YoY compared with Q2 of 2016.

Despite a fall in total investment YoY more deals were closed in Q2 2017 than the same quarter in 2016. The largest deal Canada received in Q2 went to Toronto-based Robo Advisor Wealthsimple. The company received $37m from Power Financial Corporation in a Series B round back in May.

Copyright © 2017 FINTECH GLOBAL