RenewBuy, a Gurgaon, India-based online insurance aggregator, has raised $9.2m (INR60m) from Amicus Capital.

The deal represents the second round of fundraising completed by the D2C Consulting, which owns and operates RenewBuy. It previously raised capital from Singapore-based Mount Nathan Advisors and several undisclosed high net worth individuals.

Balachander Sekhar and Indraneel Chatterjee, both of whom were with insurance major MetLife, founded RenewBuy in 2015. The company, which primarily operates in the motor insurance sector, claims to have serviced over 200,000 customers. It intends to use the new capital to expand into new geographies, and adding new product categories by branching out into health, accident and life insurance.

RenewBuy competes with the likes of PolicyBazaar, Coverfox and EasyPolicy, all of which have closed investments over the last 12 months. Policybazaar reportedly closed a funding round from Info Edge, in a deal worth around $7.7m. The new round follows a recent $77m Series E funding round which saw contributions from Wellington Management, True North and IDG Ventures, according to various reports in the media. In June, Insurance broker platform Coverfox reportedly raised $15m for its Series C funding round, which was led by US insurer Transamerica.

RenewBuy represents the first deal disclosed by Amicus Capital, a growth-stage investment firm co-launched by former Carlyle Group managing director Mahesh Parasuraman. The firm is reportedly in the market with a new fund, which is expected to close by year-end. It targets investment opportunities across financial services, consumer, healthcare, and technology sectorsm with cheques ranging between $8m and $20m.

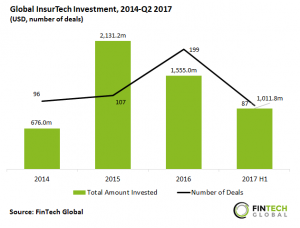

Global InsurTech

Global InsurTech investment reached record levels in Q2 2017 according to data by FinTech Global. InsurTech companies raised over $800m-worth of funding in the second quarter of the year across 34 deals.

The top 10 investments received by InsurTech companies across Q2 2017 totalled over $700m. Six of the top 10 are headquartered in the US, with Bright Health leading the way for US InsurTech investment having received a $160m-valued Series B funding round at the start of June.

Asian headquartered firms comprise the remainder of the top 10. They are made-up of India-based duo Acko General Insurance and Coverfox Insurance, as well as Singaporean firm Singapore Life. In the first half of the year, Asia represented 8 per cent of all InsurTech deals.

Copyright © 2017 FinTech Global