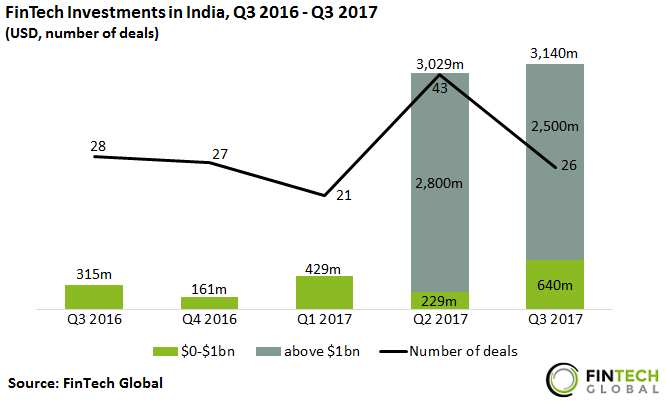

The first three quarters of 2017 saw Indian FinTech companies receive $6.6bn worth of funding

- Between 2014 and 2016 total investment to FinTech companies based in India fell by 44.5% from $2.29bn to $1.27bn. Despite the decrease in total investment, the number of deals closed rose at a CAGR of 33.6% during the same period.

- Indian E-Commerce giant Flipkart has raised $6.7bn since 2014. In March 2017, the company received $1.4bn from Tancent, eBay and Microsoft. Two months later this was followed by a $71m private equity round from Naspers. Then in August Flipkart received $2.5bn from Softbank’s Vision Fund bringing the total investment in Flipkart this year to $4.1bn. On the back of this funding round, Flipkart recently applied for NBFC license which will allow it to lend to its sellers.

- Discounting funding to Flipkart, the first three quarters of this year still saw a new record for FinTech investments in India with $2.47bn invested, double the funding received last year.

Deals valued over $1bn dominate investments to Indian FinTech companies in the last five quarters

- The second and third quarters of this year saw four deals valued over $1bn. As previously mentioned, three of these deals went to Flipkart. The remaining deal was a $1.4bn venture investment to New Delhi based payments company One97 Communications. The investment closed in May came from Softbank.

- Considering only deals valued under $1bn, Q3 2017 was a record quarter with a total of $640m invested in FinTech companies based in the country.

- Having fallen between Q3 2016 and Q1 2017, the number of deals to Indian FinTech companies peaked at 43 deals in Q2 2017 before falling back to 26 deals in the third quarter of this year.

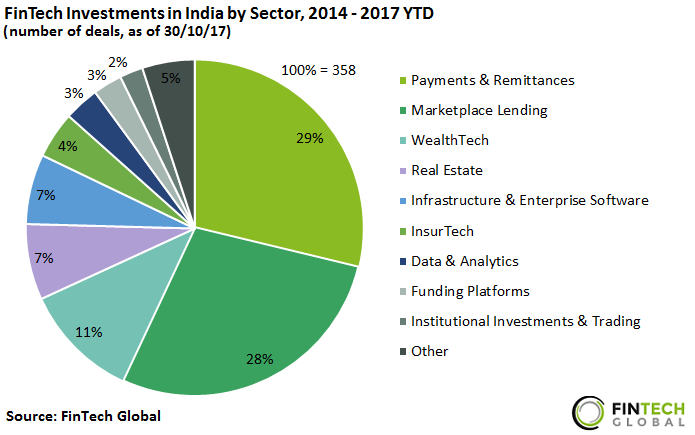

More than 50% of deals to Indian FinTech companies went to the Payments & Remittances and Marketplace Lending sectors

- Companies specialising in Payments & Remittances and Marketplace lending in India received 57% of all FinTech deals, with companies such as Faircent, a P2P lending platform, and Ezetap, a point-of-sale provider, raising multiple deals during the period.

- A further 25% of deals went to companies specialising in WealthTech, Real Estate and Infrastructure & Enterprise Software.

- Companies in the Other category received 5% of deals. These included companies specialising in RegTech, and Cryptocurrencies which received 7 and 6 deals, respectively.

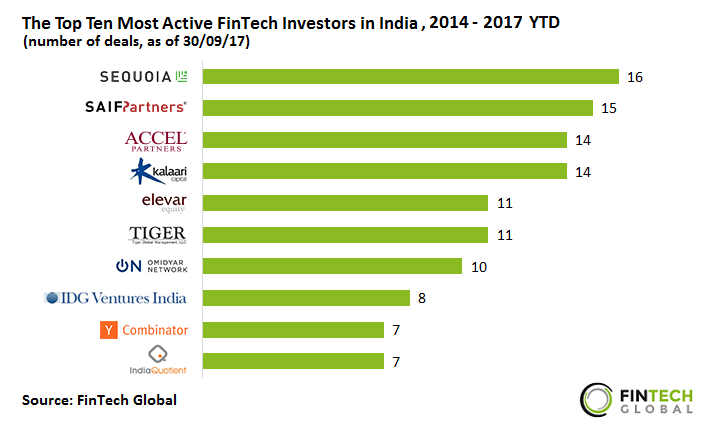

The Top Ten Most Active FinTech Investors in India participated in 25% of all deals closed since 2014

- Between 2014 and Q3 2017 the Top 10 investors in India participated in a total of 90 deals, 25% of the total number of deals to FinTech companies in this period.

- The most active investor, Sequoia Capital participated in 6.2% of FinTech investments in India between 2014 and Q3 2017. In August Sequoia Capital participated in a $45m Series C investment to Capital Float, a SME Finance company, alongside four others including the second most active investor SAIF Partners. It is common for the top investors to invest alongside each other and of the 16 investments which Sequoia Capital has made since 2014, the firm has co-invested alongside Kalaari Capital and SAIF Partners on five occasions.

- Indian FinTech companies attract a lot of investment from overseas with six of the top ten investors based in the USA and one, SAIF Partners, based in Hong Kong. The three remaining investors, Kalaari Capital, Tiger Global Management and IDG Venture India are all based within the country.