Pricing management platform Broker Genius has secured a $15m Series A funding round from Volition Capital.

New York-headquartered Broker Genius is a price automation technology solution for the live event secondary market. The platform utilises real-time market data to automate a reseller’s pricing strategy to optimise profits.

To date, the company has helped price more than $2bn in ticket inventory. Recently Broker Genius opened two new offices, one in Nevada and the other in Barcelona.

This line of capital will enable the company to further the product development, the expansion of coverage and enhancement of it big data and machine learning technology.

Future use of the technology will enable a ticket reseller to augment quantitative market information with quantitative variables. An example would be selling tickets of a baseball game. The software would augment related information with quantitative information like opposing team, starting pitchers, weather and standings. This implementation should help the seller better predict optimal values for tickets and maximise return.

Broker Genius CEO and founder Sam Sherman said, “The future of Broker Genius relies on constant innovation which is centred increasingly around big data and machine learning. Volition Capital’s investment will allow us, among other things, to continue investing in data science so we can more accurately forecast market trends and behaviours.”

Earlier in the year Volition Capital led Cybersecurity platform Securonix’s $29m Series A funding round. Participation to the round also came from Eight Road Ventures.

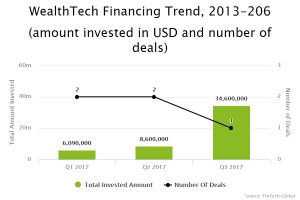

Advisory & Brokerage companies have only seen a few investments around the world. So far in 2017 there have only been five transactions completed and a total of $49.2m, of which one deal accounts for $34.6m.

Copyright © 2017 FinTech Global