The first three quarters of 2017 saw £2.1bn of investment in UK FinTech companies, almost double the total invested in the whole of 2016

- 2017 is already a record year for the UK FinTech sector in terms of funding with more than £2bn invested across 182 deals. FinTech investments valued below £75m had a CAGR of 10.7% between 2014 and 2016. This growth continued in 2017 with £1.2bn already invested in deals in this segment.

- The total investment in deals valued above £75m has also increased this year, with £877.1m capital committed so far across eight deals.

- Despite the large increase in investment only 80.2% of the number of deals closed in 2016 were completed in the first three quarters of this year. This highlights a big jump in average deal size to UK FinTech companies so far this year.

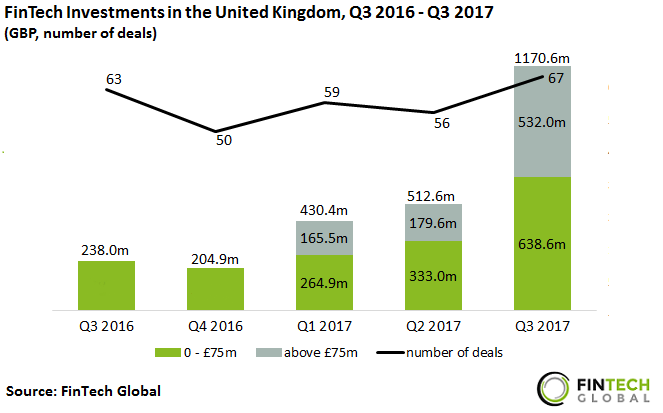

Q3 2017 saw over £1bn of investment in FinTech companies based in the UK

- Q3 2017 saw nearly £1.2bn invested in UK-based FinTech companies, the largest total investment in a single quarter to date. A total of £628.6m was invested in deals valued below £75m a 90.8% increase on the £333m invested in deals of this size in Q2 2017.

- The quarter also received record investment in large deals with £532m invested across five deals. The largest of these went to P2P lender Prodigy Finance, which raised £155m of debt financing in August.

- The number of deals completed in Q3 2017 was also a record high. The quarter saw a 6.3% increase in deal numbers YoY with five more deals closed than Q3 2016. The increased funding and deal activity shows the resilience of the industry amid political uncertainty in the country.

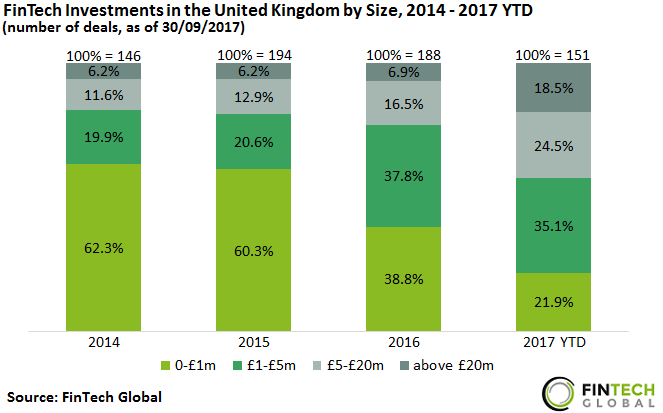

The size of investments to FinTech companies based in the UK has increased rapidly since 2014

- Between 2014 and 2016 the number of deals valued below £1m fell by 23.5%. This trend continued in the first three quarters of this year as only 21% of deals closed were within that size bracket.

- Until 2016, the fall in small deals was mostly offset by increases in deals valued between £1m and £5m. This segment saw an increase in deal share of 17.9% between 2014 and 2016.

- However, in 2017 the further fall in small deals was not offset by deals valued £1-5m as this segment remained stable. Instead the first three quarters of 2017 saw the share of large deals, valued above £5m rocket to over 40% as the UK FinTech sector shows signs of maturity. Additionally, the share of deals valued above £20m nearly tripled compared to last year.

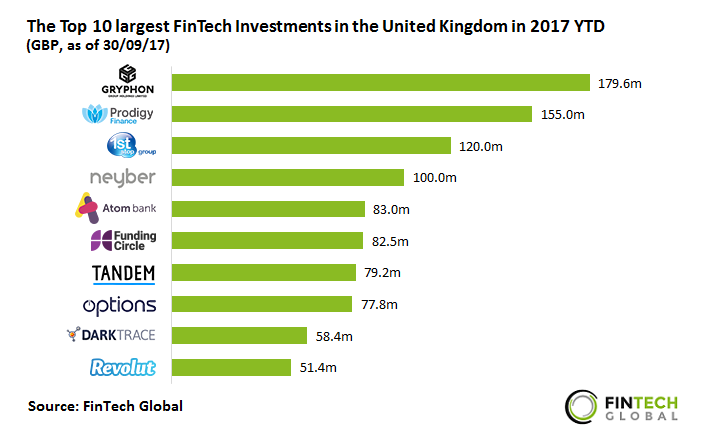

Nearly £1bn was invested in the top 10 deals closed in the first three quarters of 2017

- The first three quarters of this year saw a total of £986.9m invested in the top 10 FinTech deals to companies based in the United Kingdom. This equates to 46.7% of the total investment between Q1 2017 and Q3 2017.

- The largest deal closed in the first three quarters of this year went to Gryphon Insurance, which received £179.6m in June.

- Four of the top 10 deals went to marketplace lending companies. Prodigy Finance, 1st Stop Group, Neyber and Funding Circle received a total of £457.5m. Of the remaining six deals; two went to challenger banks Tandem and Atom Bank, two went to infrastructure & enterprise software companies Options Technology and Darktrace, and the final two went to Gryphon Insurance and Revolut which specialise in InsurTech and payments & remittances, respectively.