Mobile payment technology provider Jack Henry & Associates has acquired the entire equity of California-based Ensenta Corporation.

Founded in 2001, Ensenta supports over 1,100 financial institutions and government agencies with patterned payment technologies including ATM, mobile, online desktop, merchant and branch channels. The company helps to mitigate risk, minimise compliance exposure, increase back office efficiency and improve fund availability for consumers and businesses.

Through this acquisition, Jack Henry & Associates will now collectively support 2,300 financial institutions and expand its operations to conduct real-time transactions with third-party platforms.

Jack Henry & Associates president and CEO David Foss said, “This acquisition positions Jack Henry & Associates as the largest provider of consumer remote deposit solutions in the industry while significantly expanding the payment options we can offer to small businesses.

“Additionally, through this acquisition we will more than double the number of credit unions served by our Enterprise Payment Solutions group, opening up new relationships and cross-selling opportunities in the credit union market.”

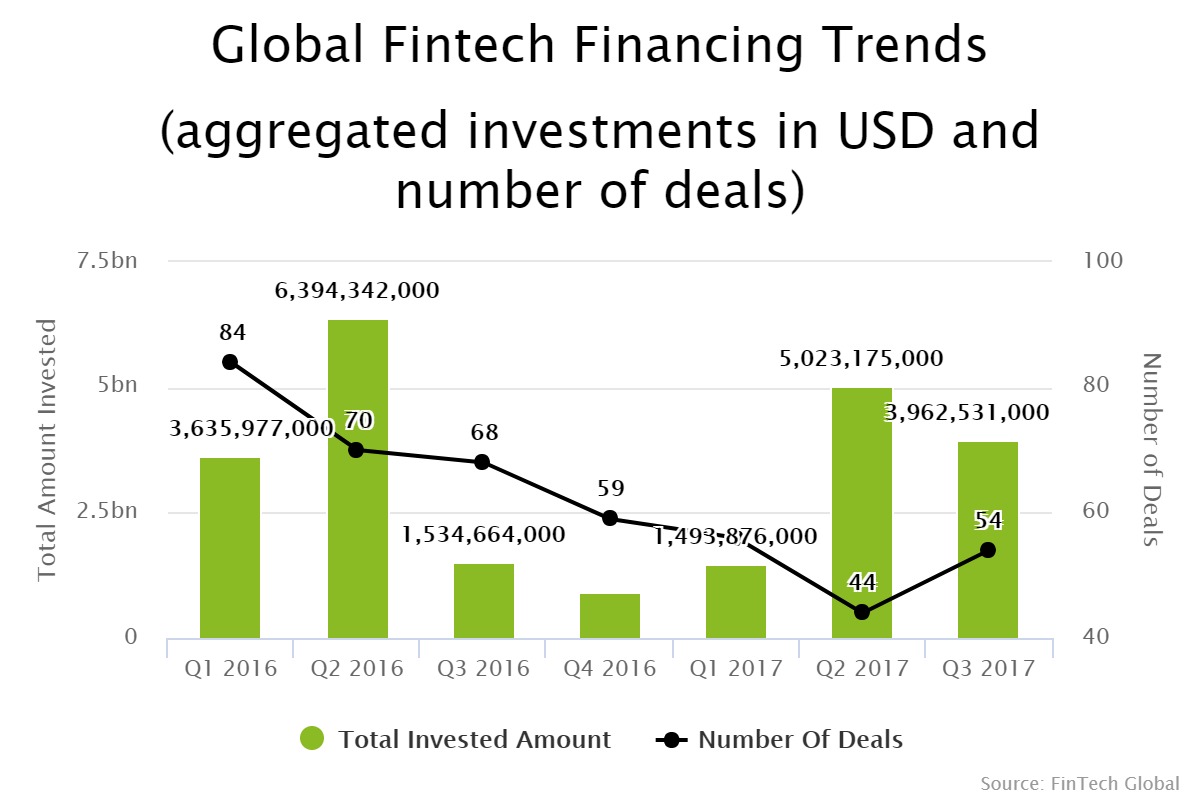

The global payments sector has seen a decline in funding since Q1 2016; however, the amount of capital invested has only seen around $1bn less funding. The first three quarters of 2016 saw $11.6bn deployed through 222 deals, while the same period this year has seen $10.4bn funded across just 154 deals.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global