Treasury management platform TreasuryXpress has closed a $5m round of funding to support product reach expansion.

Other investors to the round include Middle East Venture Partners (MEVP), iSME Capital, and The Luxury Fund.

France-based TreasuryXpress provides clients with frictionless, on-demand treasury management solutions. Currently the platform has over 10,000 bank accounts active, allowing users to have cash visibility, liquidity management, and automate end-to-end payment processing.

Following two consecutive years of triple digit growth in the US and EMEA, company is looking to develop its product. This equity line will enable the company to expand its on-demand business model into key markets which have treasury-friendly FinTech solutions.

TreasuryXpress CEO and founder Anis Rahal said, “TreasuryXpress has grown 96% over the past year, proving a clear increase in the adoption of on-demand treasury management solutions. With an estimated overall addressable market expected to reach $3.3BN by 2020, we are thrilled that our investors recognize the innovation we are bringing to the treasury and FinTech space.”

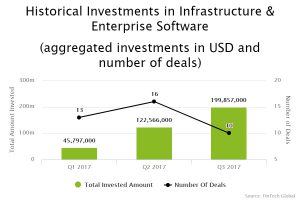

FinTech companies with accounting solutions have seen a rise in funding across the year. The third quarter of 2017 has seen more than quadruple the amount of equity deployed, than Q1. While there has been this rise in capital, there has been a decline in deal numbers, with three less being finalised in Q3 than in the opening quarter.

Earlier this month, accounting platform AbacusNext acquired HotDocs in an undisclosed deal. The company also acquired HotDocs’ e-commerce solution which allows users to buy and sell document templates.

Copyright © 2017 FinTech Global