Digital mortgage broker Ikbenfrits has closed a ?2m Series A round led by Finch Capital (formerly known as Orange Growth Capital).

Netherlands-based Ikbenfrits, which was founded in 2015, helps to simplify mortgage broking through a personalised service. The platform helps to automate several daily tasks, such as submitting and checking documents, finding and getting deals accepted instantly and streamlining digital helpdesk. The company has helped to handle more than ?150m worth of mortgage applications.

Finch Capital partner Radboud Vlaar said, ?Since its inception in 2015, Ikbenfrits has brought significant efficiencies to the PropTech industry, by targeting the refinance mortgage niche. Although the Netherlands is the second largest mortgage market in Europe, it has until now been fragmented and difficult to navigate.

?We are thrilled to work closely with the Ikbenfrits team, who in a short time have gained the largest on-line market share in this region, proving the company utility and potential to scale.p>

As part of the transaction, Finch Capital will have a representation on the company board of directors.

Earlier in the week the firm re-branded from Orange Growth Capital, in order to represent its focus on Europe and South-East Asia. This week also saw Finch Capital lead the undisclosed investment into Indonesia-based Ayopop.

In a recent interview by FinTech Global, Vlaar explained how the firm is becoming more selective of B2C investments, due to lengthy processes getting customers, and as a result it is focusing on businesses with smart marketing strategies.

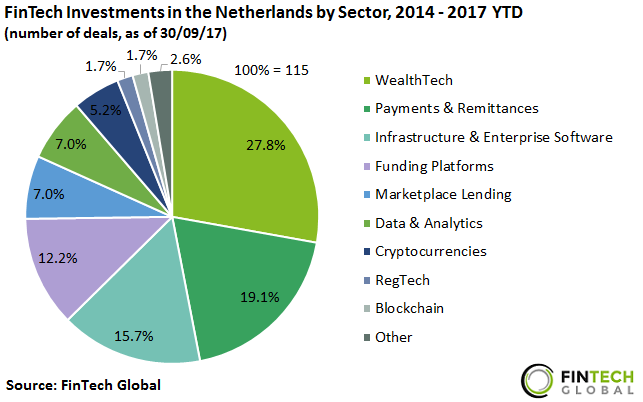

WealthTech is the biggest FinTech sector in the Netherlands, with the space accounting for 27.8 per cent of the total deals in the country. Around 60 per cent of the deals in the Netherlands went to companies specialising in WealthTech, payments and remittances and infrastructure and enterprise software.

Copyright ? 2017 FinTech Global

Copyright ? 2017 FinTech Global