Front-to-back office automation solution Lux has closed a $6m investment to fuel the company’s growth.

New York-based minority growth investor Credit Suisse Asset Management’s NEXT Investors provided the capital for the round.

The company’s technology is designed to help hedge fund firms automate a range of business processes. Lux provides solutions for research, portfolio management, accounting, operations, and investor relations.

This platform systemises the integration of traditional and alternative data from a range of sources, building cross-functional analytics reporting, which gives users access to exposure, performance, risk, and hard-to-mine data.

Credit Suisse global head of prime consulting Jeremy Siegel said, “LUX FTS provides a cost-effective and scalable reporting platform which allows end users to define and create reports on demand. The days of installing expensive data warehouses or waiting for a 3rd party to create a specific report are no longer sufficient in this fast-moving environment.”

Last month, Credit Suisse invested $200m in to SME lending platform Kabbage, to help support the company expand its AI-based business loans.

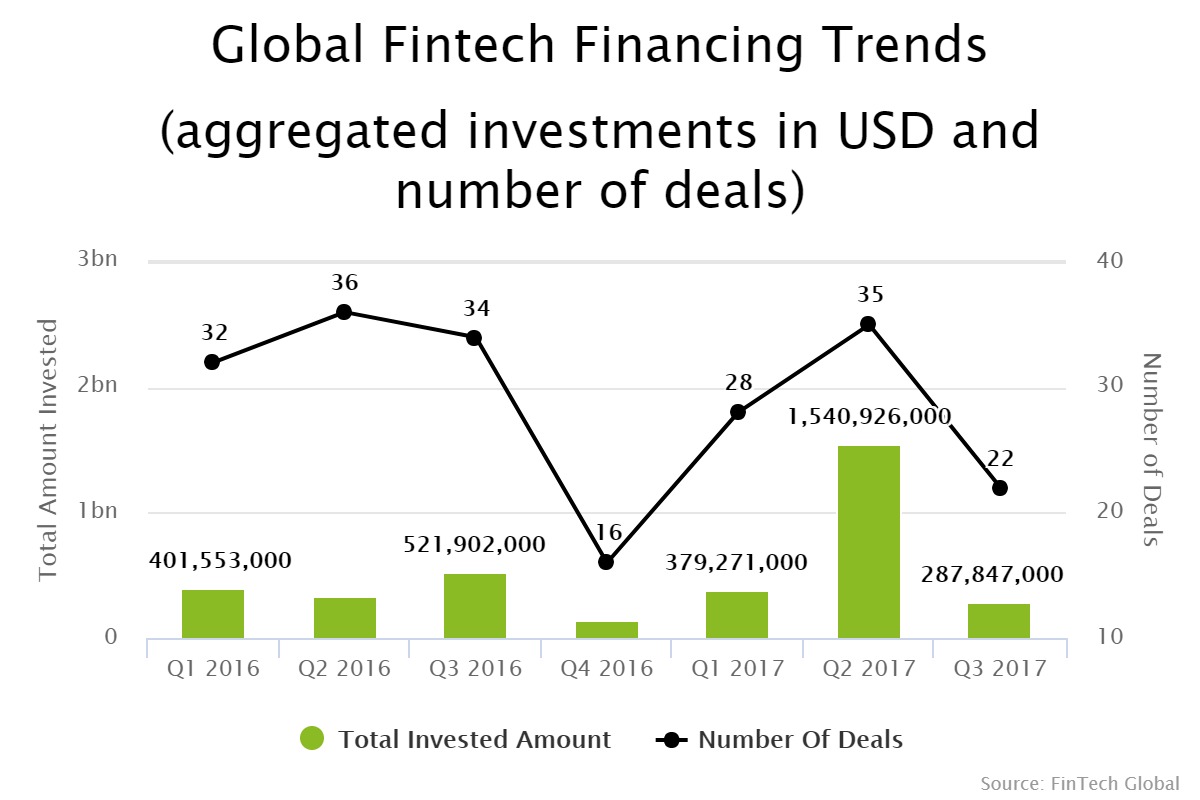

Due to a colossal Q2 2017, this year has seen a big rise in capital to the North American infrastructure and enterprise software sector. The first three quarters alone, have nearly seen double the capital than the whole of last year.

Copyright © 2017 FinTech Global

Copyright © 2017 FinTech Global