Companies in the sector received $1.4bn in the first three quarters of this year, more than double the total investment in 2016

- Investments in companies specialising in Blockchain & Cryptocurrencies increased year on year at a 14.2% CAGR between 2014 and 2016. So far, 2017 has been particularly successful for the sector with $1.4bn worth of investment so far.

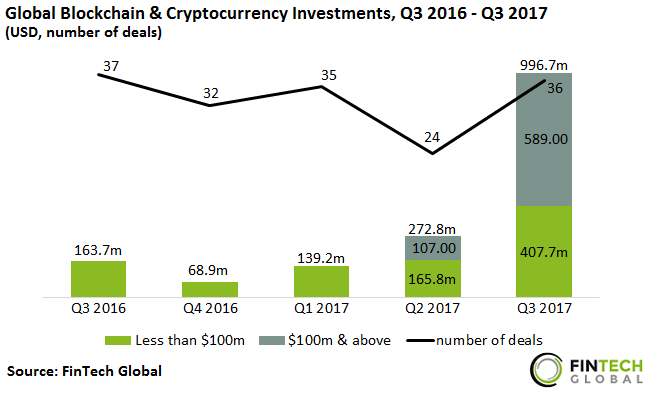

- Almost half of the funding in the first three quarters of 2017 went to deals valued $100m and above. Despite the large increase in large deals, the amount raised from deals valued below $100m has already surpassed last year’s total with $712.7m invested.

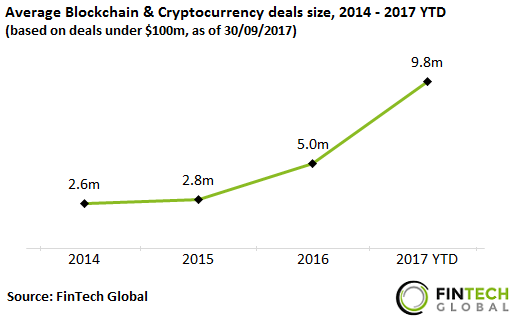

- Despite the large increases in funding the number of deals looks set to fall for a second year running. In line with this fall, the average deal size in deals valued under $100m increased at a CAGR of 41.9% between 2014 and Q3 2017.

Q3 2017 was a record quarter for investments in Blockchain & Cryptocurrency companies

- Investments in companies specialising in Blockchain & Cryptocurrencies sat

six times higher in Q3 2017 than in Q3 2016. - The number of deals closed in Q3 2017 remained reasonably consistent YoY with 36 deals closed during the quarter.

- More than half of the $996.7m invested in Q3 2017 went to two large deals. Tezos, an alternative blockchain technology, and Filecoin, a storage network for cryptocurrencies, raised $232m and $257m, respectively, in their initial coin offerings.

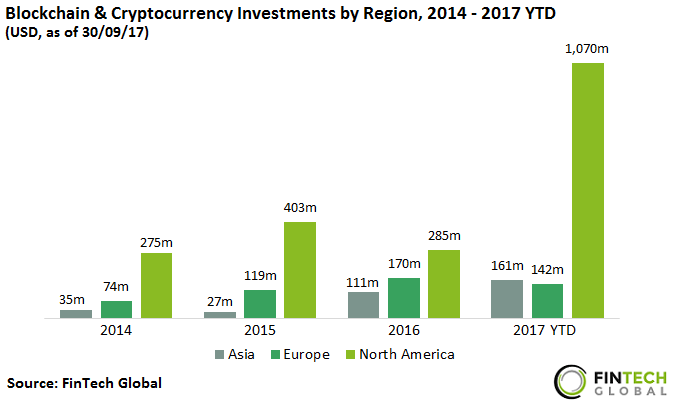

The large increase in investment is driven by deals to North American companies

- Blockchain & Cryptocurrencies companies based in North America received $1.07bn in the first three quarters of this year, accounting for 76.0% of the total investment in the sector. This is up from 50.0% in 2016.

- Total investments in Asia have steadily risen since 2014 with the region seeing a 46.9% CAGR between 2014 and 2016. Investments in Blockchain & Cryptocurrencies companies in the region will continue to grow this year as the sector has already seen $50m more invested than the whole of last year.

- In contrast to Asia and North America, Europe has had a slower year. However, with 83.5% of last year’s funding already invested in the first three quarters, investments in the region are set to grow again this year.

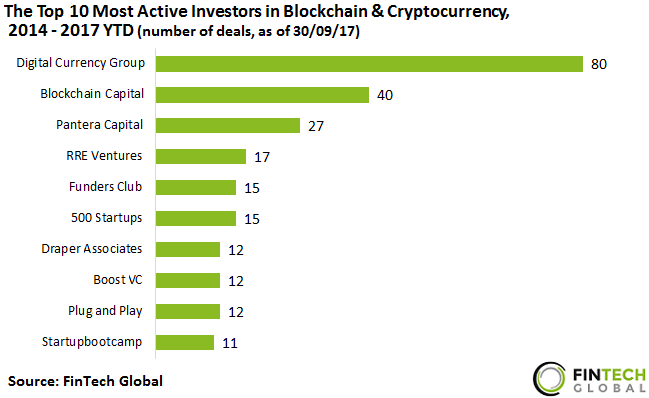

Digital Currency Group invested in 13.1% of all deals to the Blockchain & Cryptocurrency sector since 2014

- The top ten most active investors in the Blockchain & Cryptocurrency sector participated in 27.4% of all deals completed between 2014 and 2017.

- Digital Currency Group was the most active investor closing twice the number of deals closed by the second most active investor, Blockchain Capital. One of the firm’s recent investments was a $9m Series B deal to UK company Luno, which offers its customers an easy way to buy Bitcoin and Ethereum. The round, which was led by Balderton Capital, also included participation from AlphaCode Club.

- Given that the US receives such a high proportion of the total funding to this sector it is unsurprising that nine of the ten most active investors are based in the country with only Startupbootcamp based in the UK.