UK FinTech companies raised £3.07bn in 2017, more than the total of the previous three years combined

- Deals valued over £75m accounted for almost half of the funding in 2017. The total amount invested from deals in this category increased more than six-fold YoY, whilst funding raised from deals in the £0-75m category also increased by 80%.

- In contrast with the huge growth in total amount invested, there was only a modest increase in deal activity; 234 deals were completed, a figure comparable to those of the previous two years. As a result, the average deal size increased 2.6x between 2016 and 2017, from £6m to £15.5m.

- The record year for UK FinTech investment indicates a robust market in the face of Brexit-related concerns.

The UK FinTech sector ended 2017 on a high with £950m invested

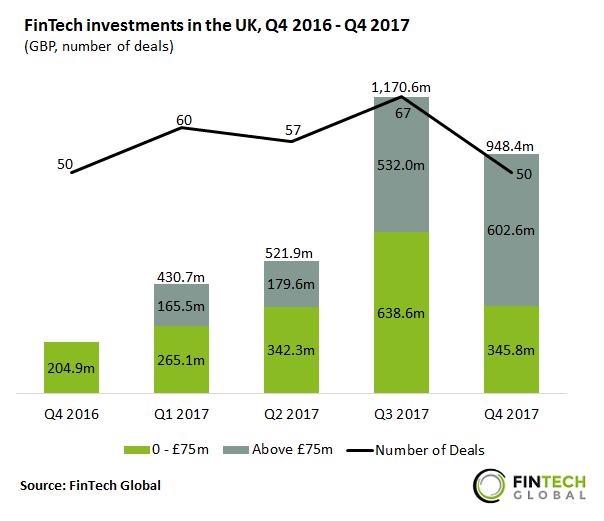

- Q3 2017 was a record quarter for UK FinTech investment with a total of £1.17bn-worth of funding. Investment in Q4 2017 remained high, reaching £948.4m which represents a YoY increase of 4.6x. This makes Q4 2017 the second strongest funding quarter for the UK FinTech sector to date.

- Three deals in Q4 2017 were above £75m including the largest deal of the year which went to P2P lending platform, Lendable. The company received £300m in debt financing from Castle Trust Capital.

- Despite the high total investment in Q4 2017, the number of deals was towards the lower end of the historical range. This points to the large portion of funding coming from a few high value deals.

Cambridge tops the list of UK cities outside of London for FinTech investments

- Of the 147 deals completed outside of London between 2014 and 2017, 15 went to companies based in Cambridge. FinTech companies in Cambridge enjoy the benefits of its proximity to London, comparatively cheaper rent and the pool of talent from Cambridge University.

- The largest deal in Cambridge went to AI cybersecurity developer, DarkTrace. The company raised £58.4m in a Series D round led by Insight Venture Partners in Q3 2017.

- London still dominates the UK FinTech sector with a total of 715 investments over the same period. However, attempts to establish other FinTech centres have resulted in promising regional hubs outside of the capital, including those in Manchester, Edinburgh and Cardiff.

The Top 10 UK FinTech deals in Q4 2017 accounted for more than 90% of the total investment for the quarter

- The Top 10 UK FinTech deals in Q4 2017 had a combined total of £862.9m which represents 90.1% of the overall amount invested in the quarter.

- Three of the top ten investments went to companies focusing on Payments & Remittances, including the second largest deal to money transfer platform, TransferWise. The company raised £212.6m in a Series E round led by IVP (Institutional Venture Partners) and Old Mutual Global Investors.

- Eight of the top ten deals went to companies based in London. Of the remaining two, Coda is based in Harrogate and Aldermore Bank plc in Peterborough.