India-based OptaCredit has secured a $4m credit facility from DMI Finance to support the support its existing offerings.

OptaCredit is an online loan platform which partners with businesses to help them provide better credit solutions for employees. The company uses machine learning algorithms to analyse traditional and non-traditional data sets to create accurate credit scores for applicants, supporting first-time borrowers.

Loans can be take out from INR 20,000 ($313) to INR 50,000 ($7,835) with a term between two months and 36 months. Interest rates range from 8.8 to 15.8 per cent and there is a 2.5 processing fee.

The company is expecting to lend more than INR 100 Crores ($15.6m) by the end of the year. The capital from this new facility will enable OptaCredit to expand its access to credit and grow its presence across geographies.

OptaCredit founder & CEO Kumar Srivatsan said, ?DMI credit line is?another indication of the comfort that financial institutions have on our underwriting processes and credit practicesp>

India FinTechs have had a very active start of 2018, with this being the seventh investment to the sector already. Investments to close last week include online payments company Razorpays $20m Series B and contactless payments developer ToneTag $1.33m round.

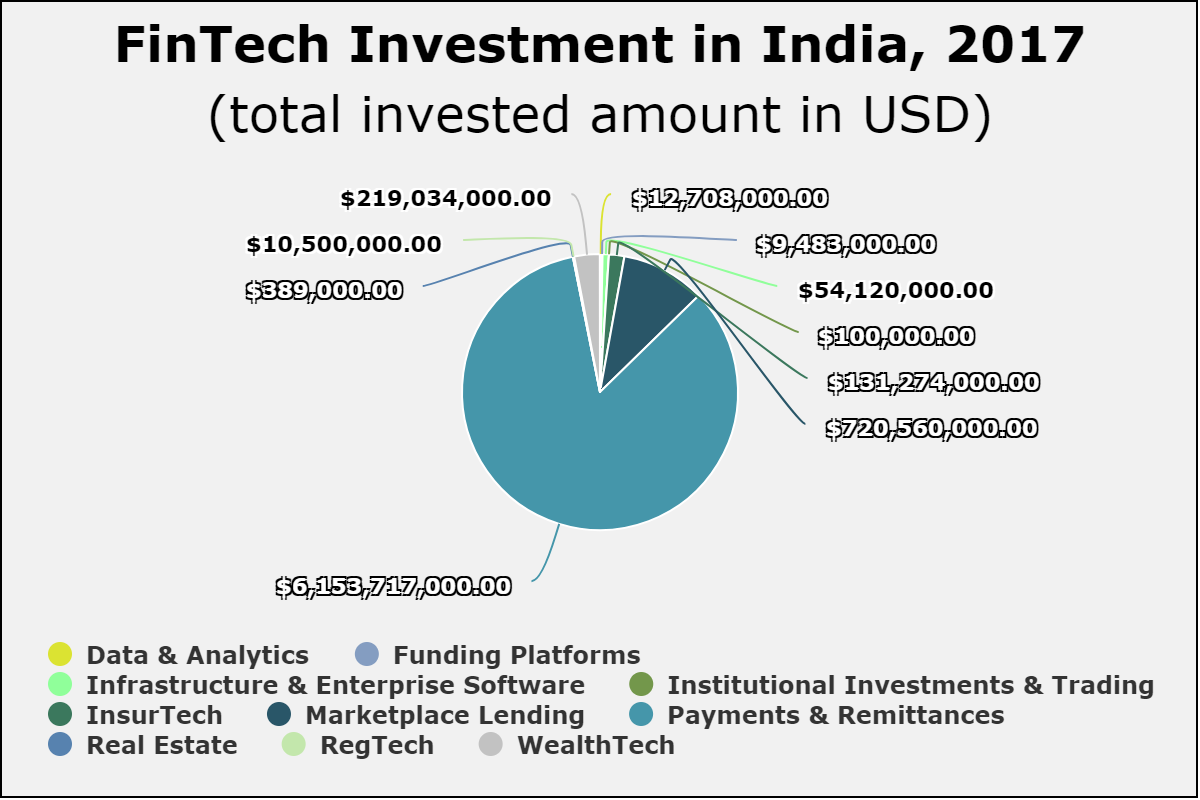

Last year, India FinTech sector was dominated by the payments and remittances sector, with it representing around 84 per cent of the total capital deployed to the country. The second biggest sector for funding was marketplace lending, with it accounting for just under 10 per cent of funding.

Copyright ? 2018 FinTech Global