The global FinTech industry received nearly $40bn-worth of funding across 1,778 deals in 2017

- Global FinTech investment increased steadily between 2014 and 2017 at a CAGR of 18.2%. The total amount invested in 2017 reached a record high of $38.9bn.

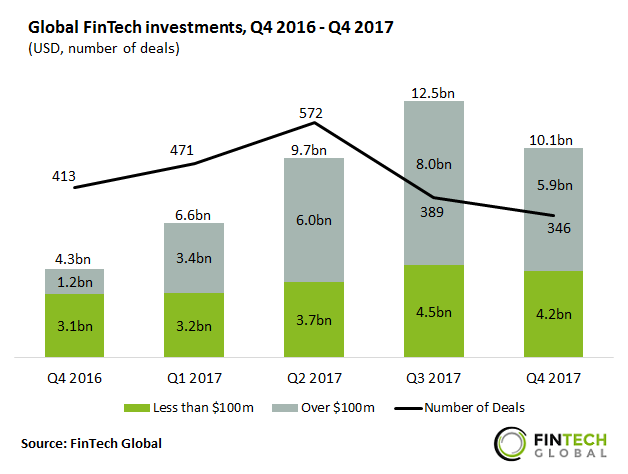

- Funding from deals valued over $100m increased by 43.3% YoY to reach $23.3bn, while deals valued less than $100m showed a more modest increase of 13.6%.

- The largest deal of 2017 went to Flipkart, an e-commerce marketplace based in India. The company received $1.5bn from Softbank in a private equity round in the third quarter of the year. The large investment positions Flipkart as a strong contender against its main competitor, Amazon India.

- Despite the growth in funding, deal activity has shown a downwards trend for the last two years. There were just 1778 deals in 2017, 6.2% less than the value for 2014.

2017 saw two of the biggest quarters for FinTech funding ever

- After a record high in Q3 2017, FinTech companies globally raised $10.1bn in Q4 2017 making it the third strongest quarter to date in terms of total funding.

- The largest deal of Q4 2017 went to Lufax, a Chinese online marketplace for the trading of financial assets. The company raised $1.2bn in a Series B round led by COFCO with co-investment from China Minsheng Bank and Guotai Junan Securities.

- Deal activity was historically low in Q4 2017 with just 346 deals completed. This represents a YoY decrease of 16.2%.

- The lack of funding from deals above $100m towards the end of 2016 and beginning of 2017 suggests that large deals may have been held off amidst the political uncertainty surrounding Brexit and the US elections.

Y Combinator holds the top spot for most active FinTech investor globally in 2017

- The top 10 most active investors in the global FinTech sector in 2017 participated in 9.9% of all deals completed during the year. All of the top 10 most active investors are headquartered in the US.

- Y Combinator was the most active FinTech investor of 2017 with 29 deals. The San Francisco-based seed accelerator model involves an intake of two classes of startups a year, in which they invest small amounts. Additionally, Y-Combinator often makes follow-on investments in its alumni. For example, they led a $120K seed round for payments services company, Flutterwave, a participant of their program in 2016. In Q3 2017, they then took part in the company $10m Series A round.

- Digital Currency Group (DCG) came in joint second with 19 deals. The company focuses on early-stage investments in the digital currency and blockchain sectors. Notably, DCG led a $2m debt financing round in Q1 2017 for Cambridge Blockchain, a provider of digital identity software.

London has overtaken New York as the top city for FinTech deal activity

- New York, San Francisco and London are consistently the top three cities globally in terms of deal activity.

- From 2014 to 2016, New York held the top spot with a deal share ranging from 34.5% to 37.6%. However, this value dropped to a low of 30.2% in 2017.

- London deal share has gradually increased over this period from 26.4% in 2014 to reach a high of 42.7% in 2017. This marks the first time London has surpassed New York to become the city with the highest number of FinTech deals. The largest deal to a London-based company in 2017 went to P2P lending platform, Lendable. The company raised ?300m in debt financing from Castle Trust Capital.