Point-of-Sale solution developer Appetize has closed a $20m Series B funding round led by Shamrock Capital Advisors.

Silicon Valley Bank also committed capital to the funding round.

California-based Appetize is a payment processing technology to businesses such as arenas, stadiums, convention centres, theme parks, campuses, and chain stores. The company provides tablet, cloud and mobile payment technologies to enable businesses to accept a range of payment methods.

The company’s POS solutions include a fixed terminal, mobile solution, handheld POS, self-serve kiosk, and online ordering. Appetize’s platform also provides clients with inventory and cash room management, stock real time updates and reporting tools.

Appetize chief strategy officer Kevin Anderson told FinTech Global, “Today, Appetize works with some of the most iconic venues and properties in the United States from coast to coast. The platform has become known as the reliable, innovative system for enterprise businesses who want more out of their POS. 2018 is already set to be a big year, capitalizing on key partnerships, executing on big wins and delivering a better guest experience.”

Last year, the company received a 100 per cent annual revenue growth and a more than 70 per cent sales win rate. Capital from this round will be used by the company to support nationwide growth plans, onboard large clients and boost the platform’s retail, restaurant and self-service functions.

Shamrock Capital partner Andrew Howard said, “Our additional investment will be used to further enhance the Appetize technology platform, enabling venue operators to have increased data and analytics capabilities as well as inventory controls, which has consistently proven to drive significant revenue uplift.”

Total funding efforts by Appetize have reached over $45m, with the company scooping up $20m for its Series A round in late 2016. The prior round was also led by Shamrock and also saw participation from Oak View Group investors Tim Leiweke and Irving Azof.

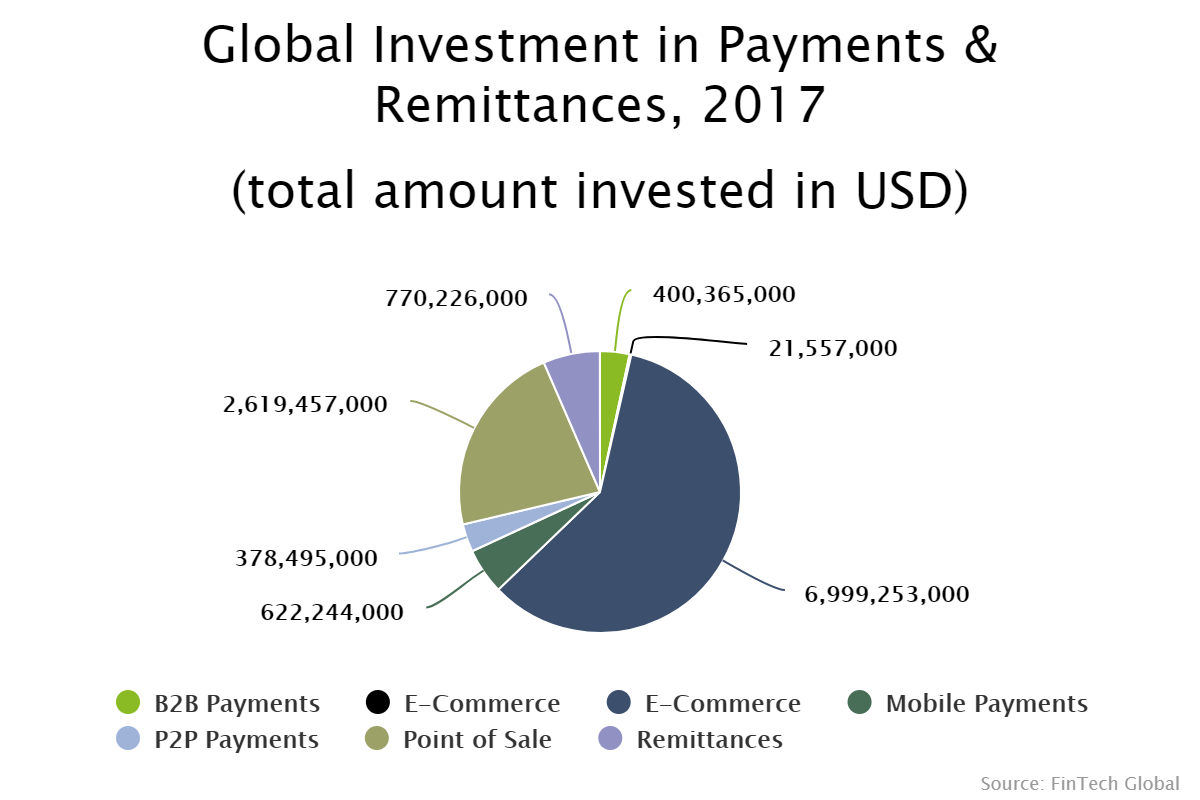

Last year, POS solution companies, represented the second largest sub-sector of the payments and remittance space. Just under a quarter of the total funding in the space was deployed in to POS solutions.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global