Flood insurance provider Neptune Flood has closed a $2m Seed round led by C1 Bank founder Trevor Burgess.

Participation to the round also came from the company existing investor and Neptune CEO Jim Albert. ?As part of the investment, Trevor Burgess and TRB Development president Jonathan Carlon will join Neptune board of directors.

Founded in 2016, the company uses mapping technology and aerial remote sensing to support its algorithms, so they can better analyse the risk of flooding. This method helps to offer better coverage and cheaper policies.

The company insurances are backed by Lloyd and helps to give same day coverage, with consumers able to purchase policies within three minutes.

Neptune is currently available in Florida, Virginia and Texas, but the company is looking to expand across a dozen more states by the end of the year. The platform is currently only available through digital agencies, MGAs and strategic partnerships; however, Neptune is looking to launch a direct consumer platform later in the year.

The capital injection will enable Neptune to expand its sales and marketing efforts nationwide and increase development of its technology solution.

Burgess said, “Neptune Flood has an amazing combination of advanced analytics, a fun brand and a team that is passionate about helping manage the flood risk for the American consumer. Neptune Flood is not only for homes in high risk flood zones but for all homeowners who are concerned about protecting the value of their home.”

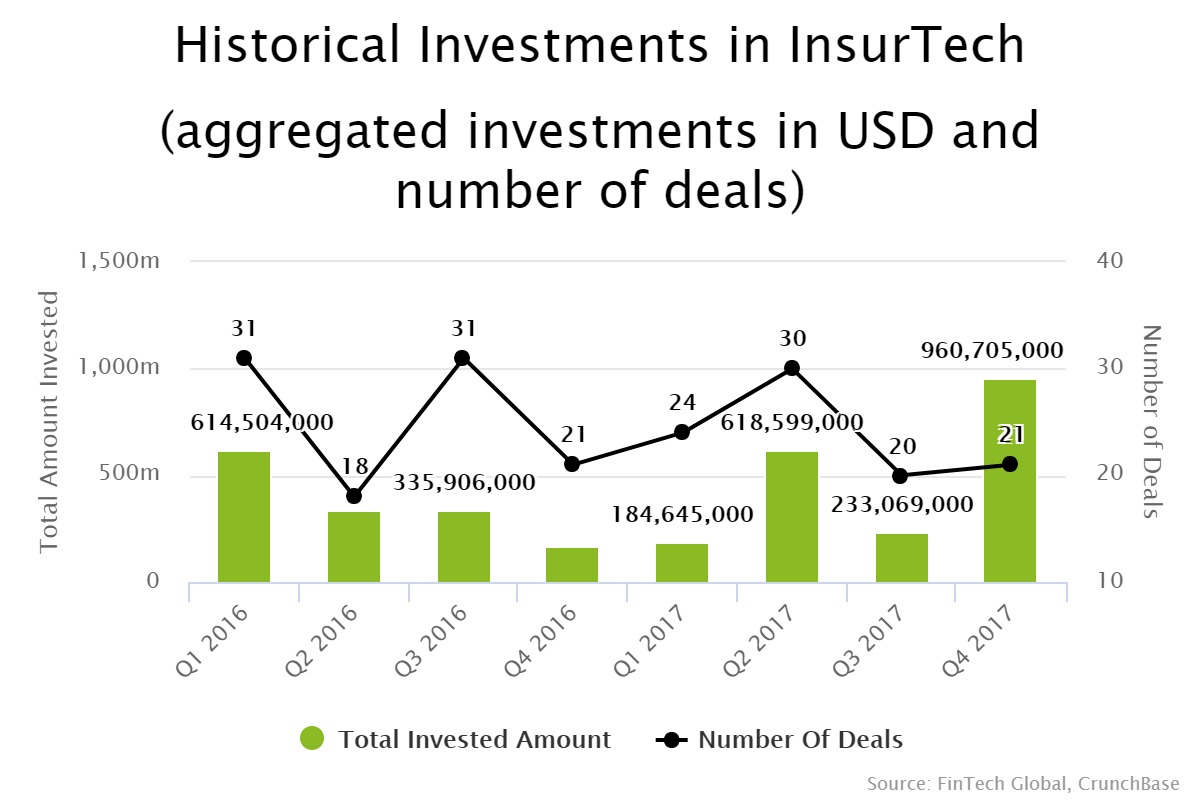

InsurTech funding looks to have recovered from its decline in funding, despite Q3 2017 seeing a low level of capital. Global investments in to the InsurTech sector last year reached $1.9bn, while the total in 2016 was just $1.4bn.