Simudyne, a company that creates AI-powered simulations for banks, has formed a partnership with PwC to boost financial services predictive power for the future.

This partnership will combine Simudyne’s simulation software with PwC’s strategy, technology and consulting expertise, in order to help financial services test scenarios, refine strategies and reduce risks in decision making to deliver greater success.

London-based Simudyne help companies to simulate their business and stress test their ability to compete within a safe environment. The platform helps traders, brokers, banks or governments to make better and safer decisions.

Through the partnerships, Simudyne will offer clients a platform which can work with existing infrastructure, while PwC will work with the clients to help shape their business and execute strategy.

Areas of advice include risk, model building, calibration and validation, regulation impact, financial crime, mobile innovation and digital technologies, among others.

Simudyne chief executive Justin Lyon said, “From running scenarios for stress testing to strategically allocating capital, simulations enable banks to deliver higher-performance on a day-to-day basis; strengthening earnings, ensuring adequate capital no matter what happens in the world and driving improvements in asset quality.

We believe that, by simulating accurate models that combine causation and correlation approaches, executives that hone their decision making in simulators make much better decisions than those that don’t.”

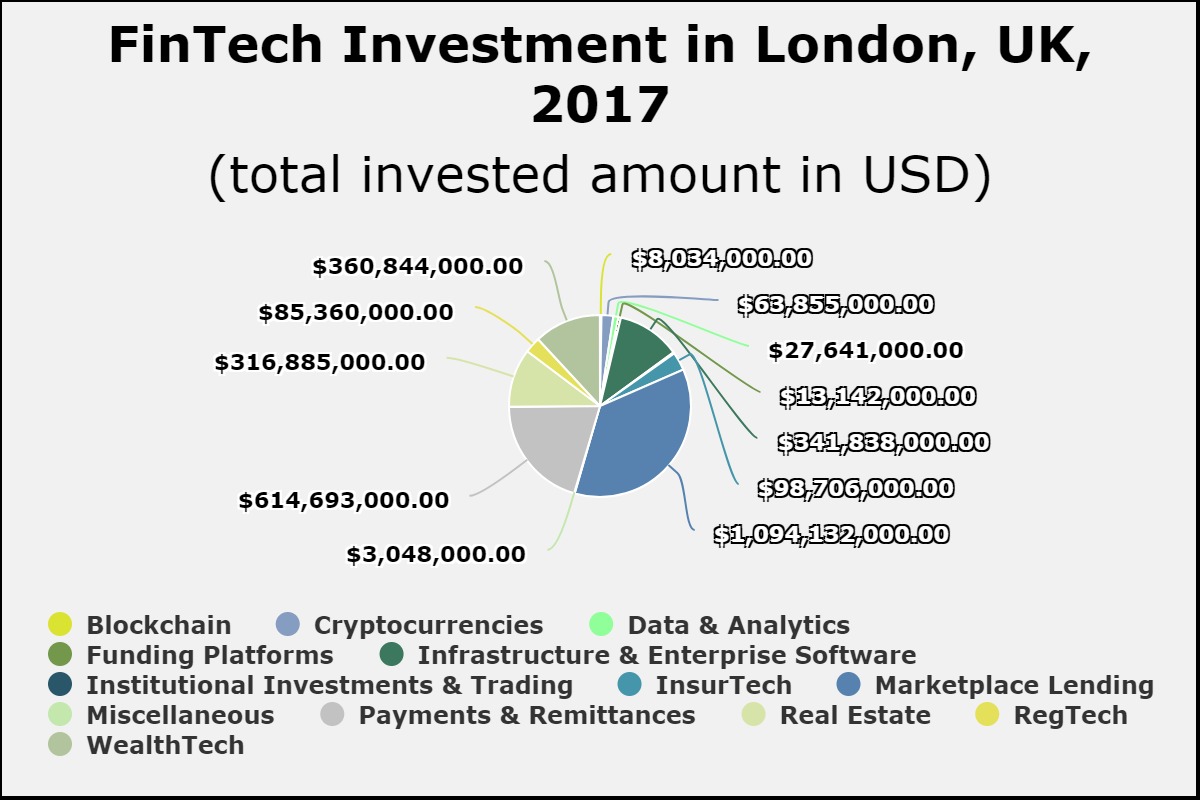

Lat year, London’s biggest FinTech sector for funding was marketplace lending, with it receiving $1bn which is around 36 per cent of the total capital deployed. The data and analytics space picked up $27m, which is around 1 per cent of the overall investments.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global