Blockchain-powered payments and settlements platform SETL has received an undisclosed investment from Crédit Agricole CIB.

The minority investment from Crédit Agricole marks its first commitment in to a FinTech company.

Founded in 2015, SETL is a blockchain technology developer that builds solutions for the multi-asset, multi-currency institutional payment and settlements infrastructure. The platform enables users to move cash and assets between each other immediately.

London-based SETL uses a distributed ledger of ownership, which helps to keep track of transactions, helping to simplify matching, custody and transaction reporting.

A range of industries have utilised the technology, with it helping to facilitate multi-currency cross-border transactions or implement commercial invoices. Mutual funds and private equity firms have also used the OpenCSD product that can standardise ownership and mange history records.

SETL CEO Peter Randall said, “We are unique in having both a financial grade blockchain product and a proven deployment route. SETL has successfully deployed multiple environments capable of processing in excess of 80,000 transactions per second across over 100 million accounts concurrently in a globally distributed configuration.

“As a result of this technological capacity SETL have already received significant further indications of interest in our OpenCSD product, especially from organisations who are prominent members of competing offerings.â€

A range of blockchain-based startups have raised capital this year already. Dominode,which develops a suite of solutions to protect, secure and authenticate digital identity, secured a $1.3m funding last week. ModulTrade, a B2B trading platform, formed a strategic partnership with Alibaba’s investment division last week.

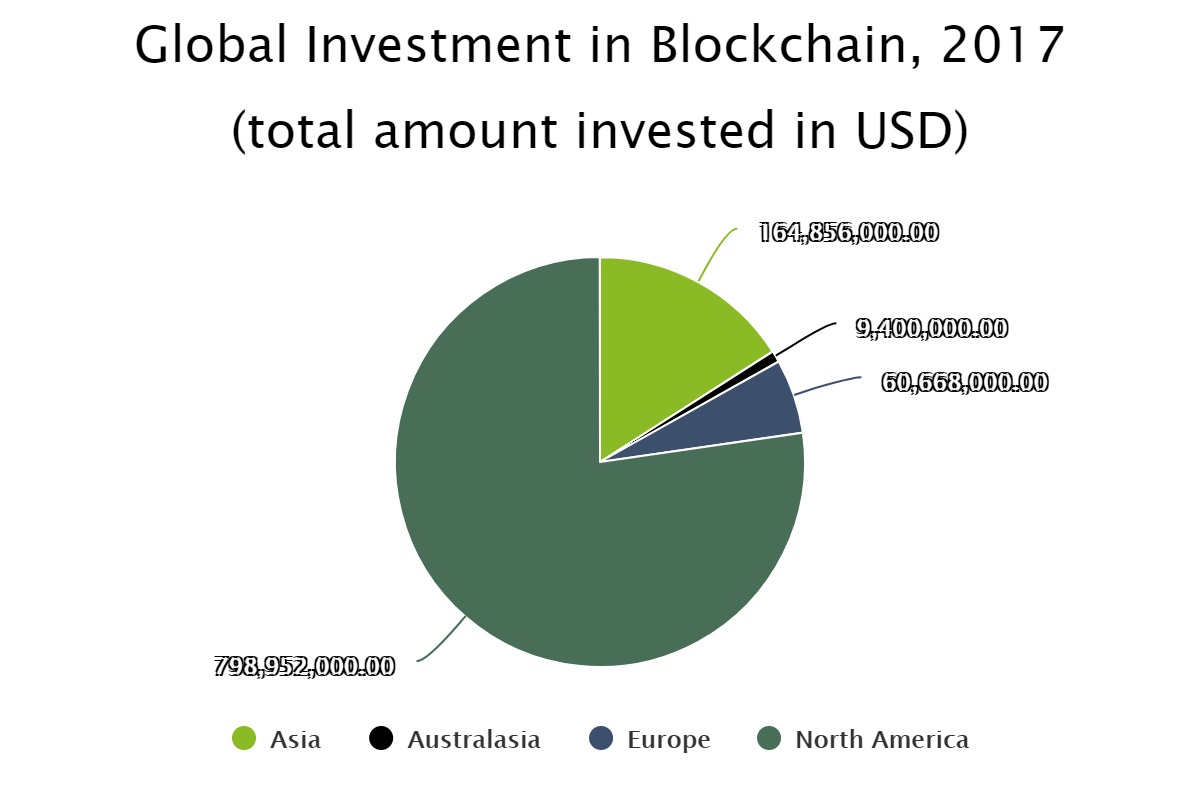

Last year, around $1bn was invested in to blockchain companies around the world. Of this capital, just over three-quarters went to companies based in the US.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global