FinTech investments in France reached $297.8m across 41 deals in 2017

- Investment in French FinTech companies increased rapidly at a CAGR of 47.8% between 2014 and 2017. The total amount invested in 2017 reached a record high of $297.8m.

- Despite the growth in capital invested, there was only a modest increase in deal activity in 2017; 41 deals were closed in total, just one more than the previous year. As a result, the average deal size jumped 32% during that period from $5.9m to $7.8m.

- The largest deal in 2017 went to consumer lending platform Younited Credit. The company raised $47.8m in a Series F round in Q3 2017. Participating investors included, among others, Bpifrance, Zencap Asset Management and Eurazeo.

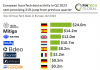

FinTech investment in France slowed down in Q4 2017 after hitting a record the previous quarter

- Q3 2017 was a record quarter for FinTech investment in France with $103.2m-worth of funding. This surge in funding was driven by Younited Credit’s $47.8m Series F round, as well as finance management platform Linxo’s $24m venture round.

- Capital invested returned to a historically healthy level of $68.1m in Q4 2017. This is within range of the same quarter in 2016.

- Deal activity remained steady in Q4 2017 with 9 deals closed, the same total as the previous quarter.

- The largest deal in Q4 2017 went to insurance fraud detection provider, Shift Technology. The company raised $28m in a Series B round led by General Catalyst and Accel Partners with co-investment from Iris Capital and Elaia Partners.

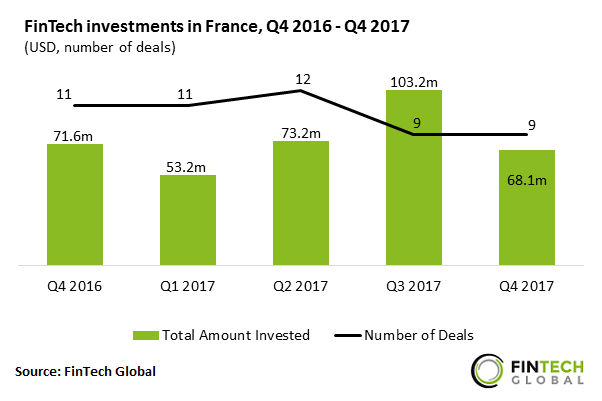

Deals valued between $5-10m nearly doubled in share in 2017

- Aside from the appearance of deals valued over $25m in 2015, there was little evidence of a definitive shift towards larger deals between 2014 and 2016.

- However, in 2017 deals valued under $5m decreased in share by 16.5%. This fall in smaller deals was taken up by those in the $5-10m category which increased in share by 1.9x over the same period.

- Notable investments in the $5-10m category in 2017 include cryptocurrency wallet provider Ledger’s $7m Series A round led by MAIF Avenir, as well as robo-advisor Yomoni’s $5.4m funding round from Crédit Mutuel Arkea and Iena Venture.

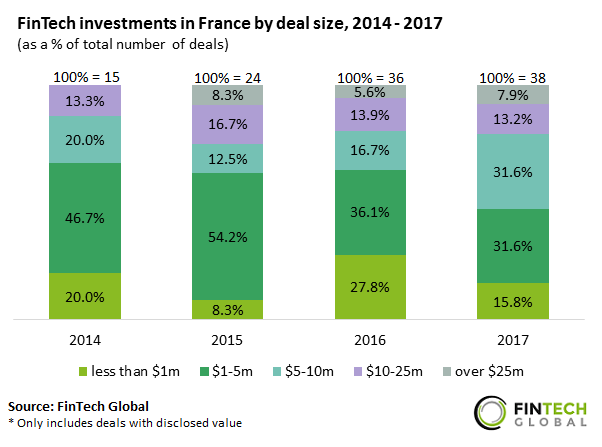

The top ten French FinTech investments in 2017 raised almost 70% of the funding for the entire year

- The top ten FinTech deals to French companies in 2017 raised a total of $203.2m which equates to 68.2% of the total amount invested during the year.

- The largest investment in 2017 was the previously mentioned $47.8m deal to Younited Credit. This was followed by a $31.9m deal to HR Path, an HR solutions provider. Its venture round in Q2 2017 saw participation from Societe Generale Capital Partenaires, Ardian and Activa Capital.

- All top ten deals went to companies based in Paris with the exception of Linxo which is headquartered in Aix-en-Provence. Linxo, a personal finance management service, raised $24m in a venture round from MAIF, Credit Mutuel Arkea and Credit Agricole.

- Four of the top ten deals in 2017 are within the ten largest FinTech deals in France to date.