Maharashtra has become the first state in India to adopt a comprehensive FinTech policy that aims to foster an environment for FinTech startups.

It is aiming to establish a Global Fintech Hub in the Mumbai Metropolitan Region, as it looks to make the state one of the top five FinTech centres in the world in the next five years.

The state cabinet approved the policy under which the government would facilitate establishment of 300 start-ups in this sector in the next three years. It is also planning a venture capital fund of Rs200 crore for fintech start-ups.Under the new FinTech policy, eighty-five per cent of the built-up area will be reserved for start-ups in the financial technology sector. In central Mumbai, 10,000 sq ft will be reserved for fintech companies; and co-working spaces will be provided at reasonable rates.

Fintech start-ups with an annual turnover of up to Rs25 crore will get 10 lakh annually for a period of three years. And internet charges and electricity bills will be reimbursed. The FinTech startups will also get goods and services tax rebates.

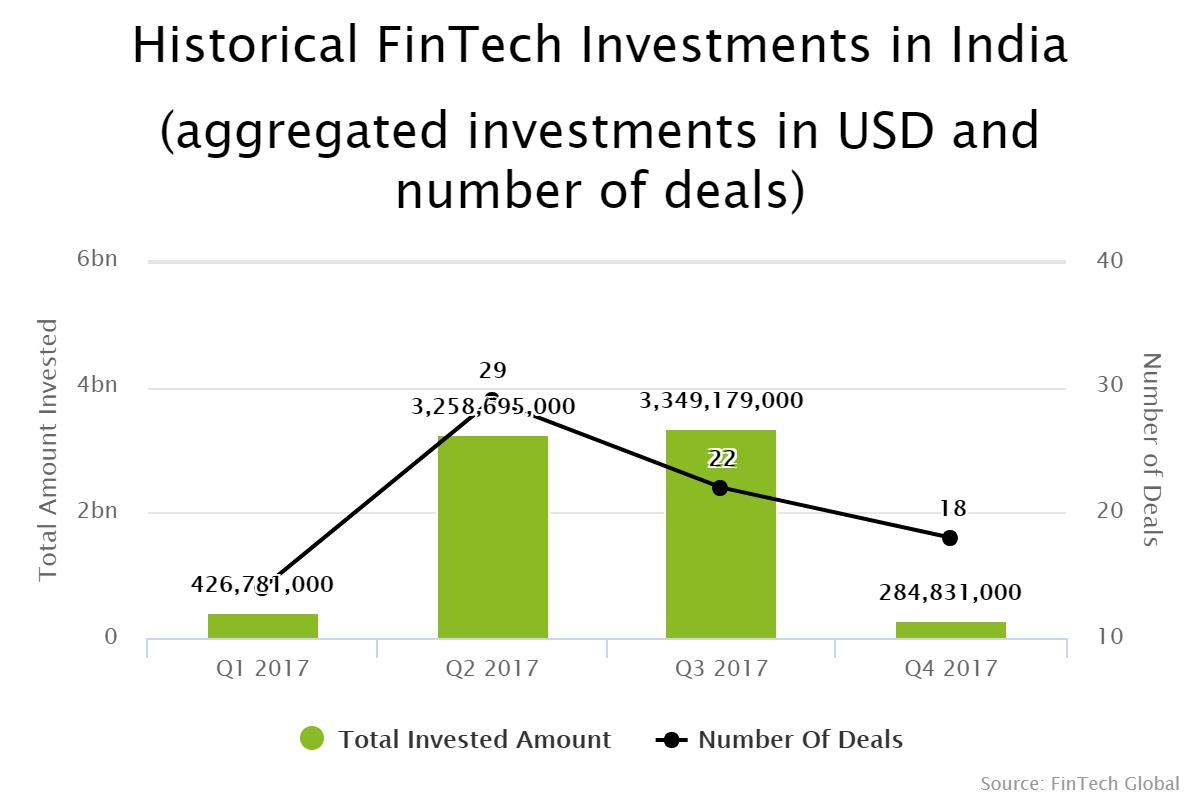

FinTech investments in India are growing rapidly as investor’s appetite for the region increases according to data by FinTech Global. Last year, more than $7bn was invested in the country’s FinTech space. This was a significant increase on the $1.2bn invested during 2016.

Last month, personal finance mobile app IndianMoney.com secured a $3m funding round from SRI Capital and Hyderabad Angels. IndianMoney.com is a financial wellbeing app that helps consumers understand what they are buying and what they need.

In December, Bangalore-based Happay, an expense management platform for enterprises, reportedly raised $10m in a Series B funding round, while, Indian online home rental startup NestAway Technologies reportedly raised $50m.

Copyright © 2018 FinTech Global