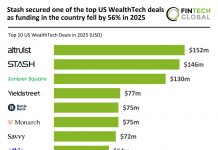

Personal finance platform Stash has closed a $37.5m Series D round led by Union Square Ventures.

Other participants to the round included Breyer Capital, Coatue Management, Entree Capital, Goodwater Capital and Valar Ventures.

New York-based Stash is a personal finance app that helps consumers to spend, save and invest their money. The platform, which is used by more than 1.7 million, helps to build personalised investment portfolios which reflect savings goals and interests.

Smart-Save technology can save money for users by studying their spending and earning patterns and automatically moving spare cash in to a saving account. The platform ensures money is never transferred when a checking balance is low, and money can be withdrawn for free. The Stash Coach solution helps clients build a balanced portfolio to help build up their savings.

Later in the week, the company is launching its Custodial Accounts, which will allow parents open investing accounts for minors.

Union Square Ventures partner Rebecca Kaden said, “Through customer focus and a data-driven mindset, Stash has been able to create a powerful consumer brand, with unprecedented growth, on its journey to fix the inequities plaguing financial opportunity across the U.S. We’re excited to join them on this mission to shake up the status quo.”

Following the latest investment round, Stash has raised up to $111m in total funding. Last year, the company picked up a $40m Series C round from Coatue Management, Breyer Capital, Goodwater Capital and Valar Ventures. The capital was raised to support the development of its Stash Retire solution for iOS.

Last year, Union Square Ventures took part in the $18.5m Series B funding round in to insurance support solution CoverWallet. The company leverages data to help small businesses access digitally tailored advice and products.

Copyright ? 2018 FinTech Global