TruFin, a FinTech and banking group, has raised ?70m through the sale of ordinary shares on the London Stock Exchange.

The shares were sold on the AIM Market of the LSE and were priced at 190p a-piece.

London-based TruFin was originally spun out of Arrowgrass Master Fund, and operates across three lending markets: supply chain finance, invoice finance and dynamic discounting. TruFin owns short-term lender for supply chains Distribution Finance Capital, early-payment solution provider Oxygen Finance, and invoice finance platform Satago.

Alongside this, TruFin owns a 15 per cent minority stake in P2P lending company Zopa and operates independently from TruFin. Both Zopa and DFC are seeking UK banking licences, while Oxygen is looking to expand in the corporate sector and Satago is searching for strategic partnerships.

TruFin CEO Henry Kenner said, “I am delighted to announce our intention to join the AIM market of the London Stock Exchange. Listing on AIM will allow us to provide further capital to our subsidiaries and scale faster, and take advantage of any developments in the current financial services market.”

Last year, Zopa closed a ?32m funding round co-led by Wadhawan Global Capital and Northzone, to support the launch of its banking services.

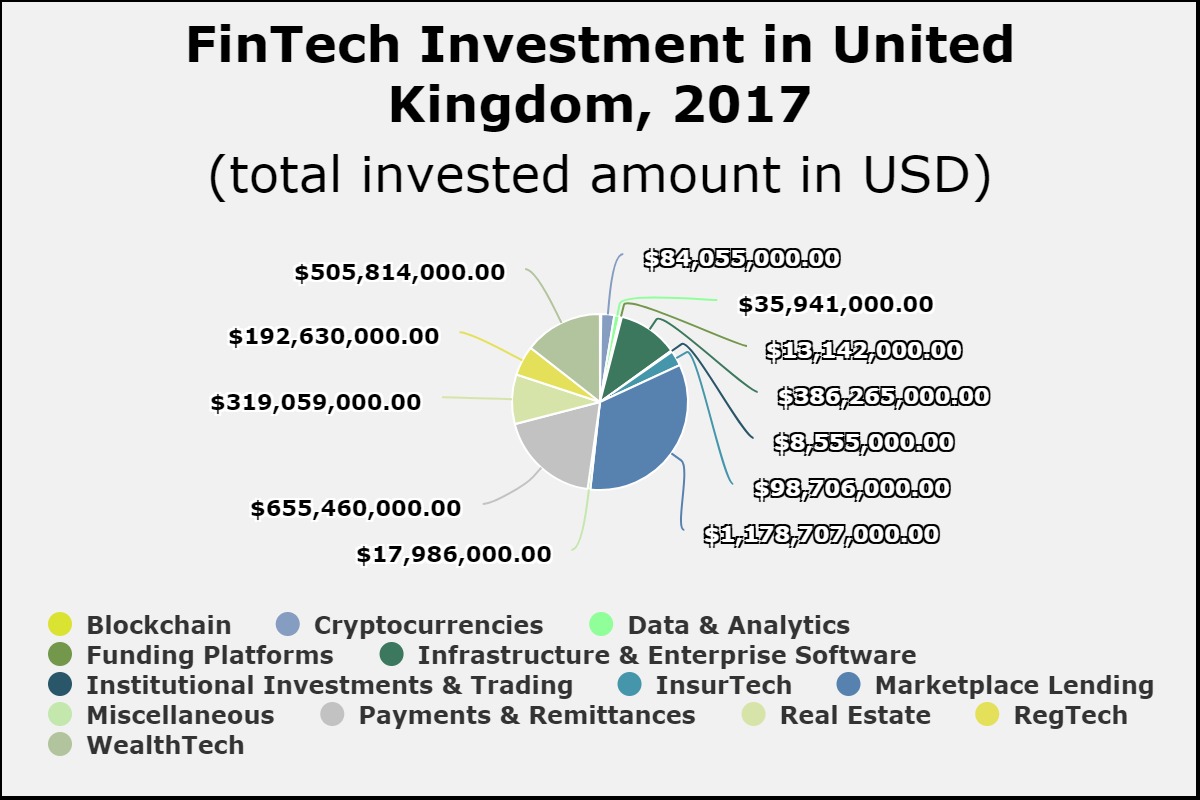

The marketplace lending sector received the biggest share of capital in the UK FinTech sector, last year. A total of $1.1bn was invested in the space last year, representing 33 per cent of the total equity invested in the country.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global