Greenlight Financial Technology, a personal finance platform for children, has picked up $16m for its Series A funding round led by TTV Capital.

Other participants to the investment included existing investors New Enterprise Associates and Relay Ventures. The company also received commitments from new backers to the company including SunTrust Bank, Ally Financial, nbkc bank, Canapi, and the Amazon Alexa Fund.

Greenlight is a financial platform for children, providing them with a mobile app and a debit card to help them control their finances. Parents are able to have some control in the child expenditures by setting what stores they can spend money.

The platform, which can be shut off via the app, allows children to access spend anywhere allowances, and request more funds from their parents if needed. Making savings can also be incentivised through the platform, by parents able to set interest rates to their kids.

This capital will be used to support the company growth plans and to invest in new talent in order to keep up with consumer demand and launching new products.

TTV Capital partner Tom Smith said, “Greenlight’s impressive growth is attracting partners who value its family-friendly approach, just as we do,” “This unique solution for financial institutions is going to change the way parents teach the next generation about managing finances and will help to increase the overall financial literacy of consumers.”

Last year, the personal finance company picked up a $7.5m Seed investment led by Relay Ventures. Other participants to the round included Social Capital, New Enterprise Associates (NEA) and TTV Capital.

This is the second child-focused personal finance platform to close an investment this week. Dojo Technology nabbed an undisclosed investment from Vested Ventures to help boost its brand across the US and Canada.

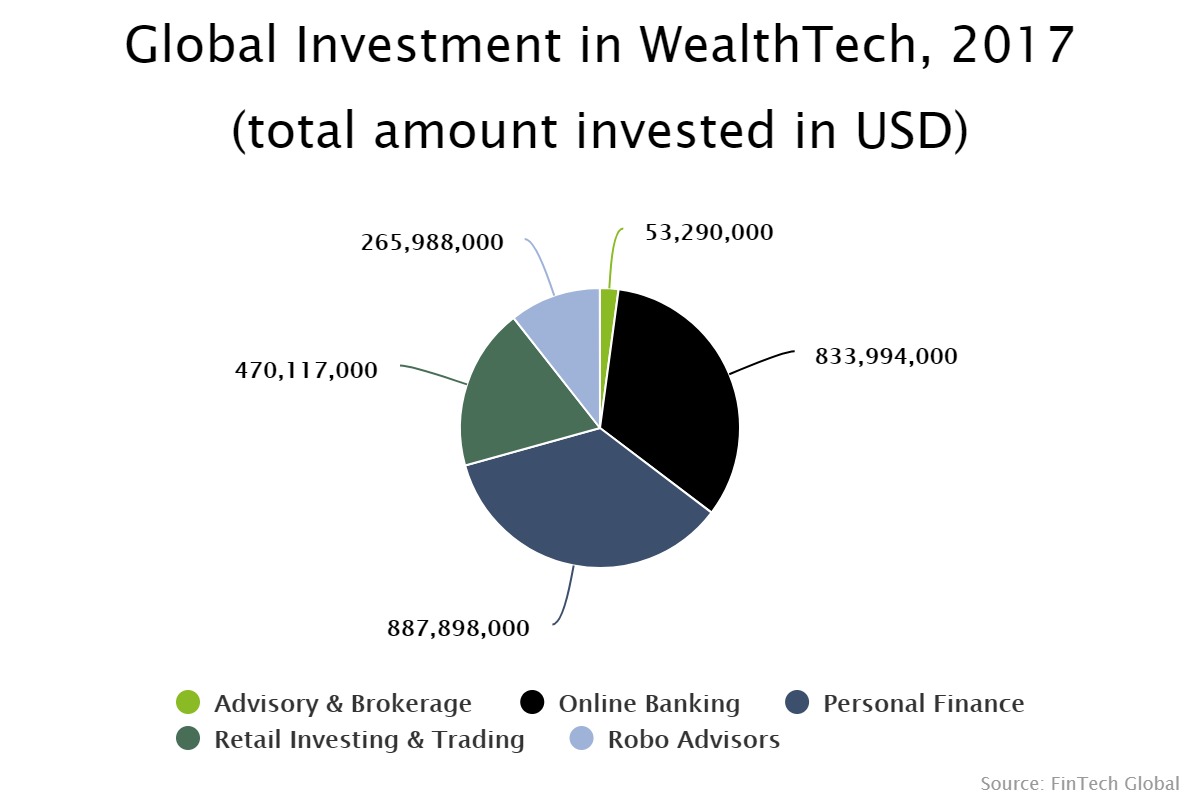

Last year, half of the funding into the personal finance sub-sector of WealthTech, went to companies in Asia.

Copyright ? 2018 FinTech Global