The Marketplace Lending sector saw nearly $9bn invested across 233 deals in 2017

- Investment in the Marketplace Lending sector slowed down in 2016 with a YoY decrease of 12.8%. Total amount invested fell from $8.6bn in 2015 to $7.5bn the next year.

- 2016 proved to be a challenging year for Marketplace Lending. This was particularly true in the US where industry leader Lending Club was embroiled in scandal; the company’s lending practices were called into question, and its CEO failed to disclose a financial conflict of interest. As a result, lending companies faced increased scrutiny and difficulties in attracting funding.

- However, investment rebounded in 2017 to reach $8.9bn which represents a YoY increase of 18.6%. This makes last year the strongest to date for global Marketplace Lending funding.

- Despite the growth in funding, deal activity declined from 277 deals in 2016 to just 233 deals in 2017. This resulted in the average deal size jumping from $32.5m to $45.4m over the same period.

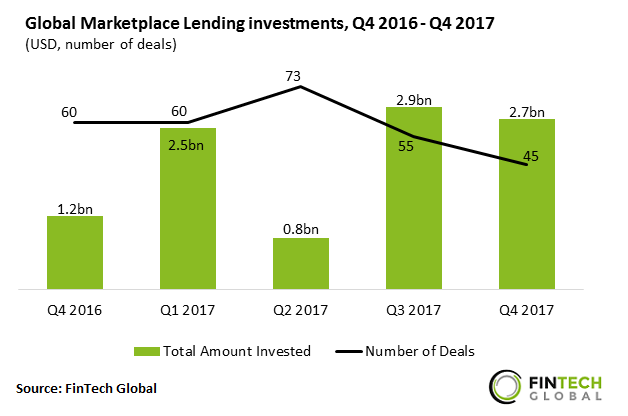

The second half of 2017 saw two of the strongest funding quarters to date

- Q3 2017 and Q4 2017 were the second and third strongest funding quarters, respectively, for the Marketplace Lending sector. The strongest quarter was Q3 2015 when $3.1bn was invested in the sector globally.

- The largest Marketplace Lending deal of the year was closed in Q4 2017. Shanghai-based Lufax, a P2P lending platform, raised $1.2bn. The Series B round was led by COFCO with co-investment from China Minsheng Bank and Guotai Junan Securities.

- Despite the high total investment, deal activity was historically low in the final quarter of 2017 with just 45 deals completed.

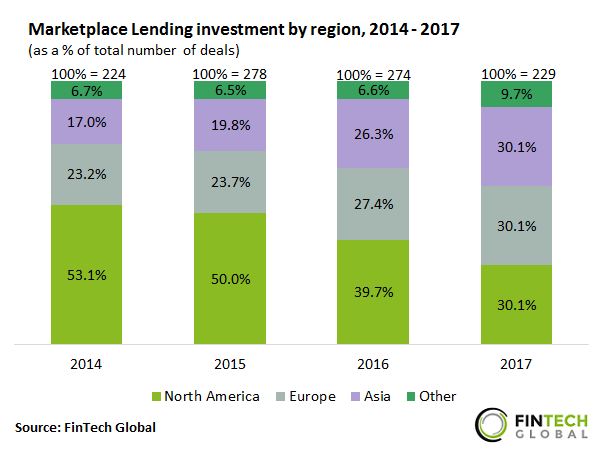

Marketplace Lending investments are spreading geographically

- In 2014, more than half of all Marketplace Lending deals were closed in North America. This has gradually decreased every subsequent year to reach a share of 30.1% in 2017.

- Meanwhile, the share of total deals completed in both Europe and Asia increased over the same period to become equal with North America in 2017. Europe had a deal share of 23.2% in 2014 which rose to 30.1% last year, while Asia saw the largest increase from 17% to 30.1% over the same period.

- ‘Other’ regions including Africa, Australasia and South America maintained a steady share of deals between 2014 and 2016 with a range between 6.5% to 6.7%. This value rose to 9.7% in 2017. The largest deal in this category in 2017 went to Sydney-based consumer lending platform MoneyMe. The company received $91.5m in debt financing from Fortress Investment Group with co-investment from Evans & Partners.

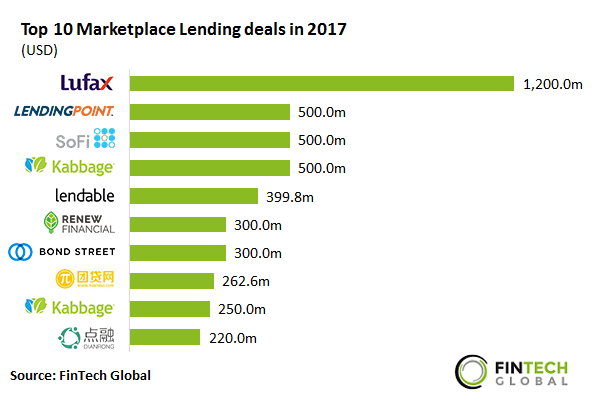

The top ten Marketplace Lending deals in 2017 raised half of the total funding for the year

- The top ten deals in the Marketplace Lending sector in 2017 raised a combined total of $4.4bn. The largest deal last year was the previously mentioned $1.2bn Series B round to Lufax.

- The next three top deals all raised $500m and went to US-based companies: online loan provider LendingPoint in a debt financing round from Guggenheim Securities; lending and wealth management specialist SoFi in a Series F round led by Silver Lake Partners; and SME lending platform Kabbage in a debt financing round.

- Four companies in the top ten are P2P lenders, while a further three offer solutions in each of the Online Loans and SME Finance subsectors.