Micro-finance banking software developer Oradian has closed funding from Goodwell Investments, just days after its previous equity round.

The terms of the transaction were undisclosed, but comes after Middleton Enterprises committed ?100,000 to Oradian, last week.

Croatia-based Oradian develops cloud-based core banking platforms for microfinance institutions, helping to counter high operational costs and geohazards. The company hopes to boost financial inclusion by helping financial institutions reach more remote clients.

Through the technology, microfinance institutions can implement administration, accounting, security, loan portfolio management and deposit tracking solutions.

The company initially deployed in Nigeria, growing its customer base to 24 micro-financial institutions and 489,000 end users. The company then received support from the Philippine Centeral Bank to expand to the country. It now supports 18 MFIs in the country and has doubled its end users.

Capital from the new round will support its growth across Africa and expand its commercial teams.

Last year, Nigeria-based agriculture crowdfunding platform Farmcrowdy closed a $1m seed investment from a group of investors including Cox Enterprises and Techstars Ventures. ?The company helps farming in the country by investors supporting farm cycles and earning a share of the profits after the harvest.

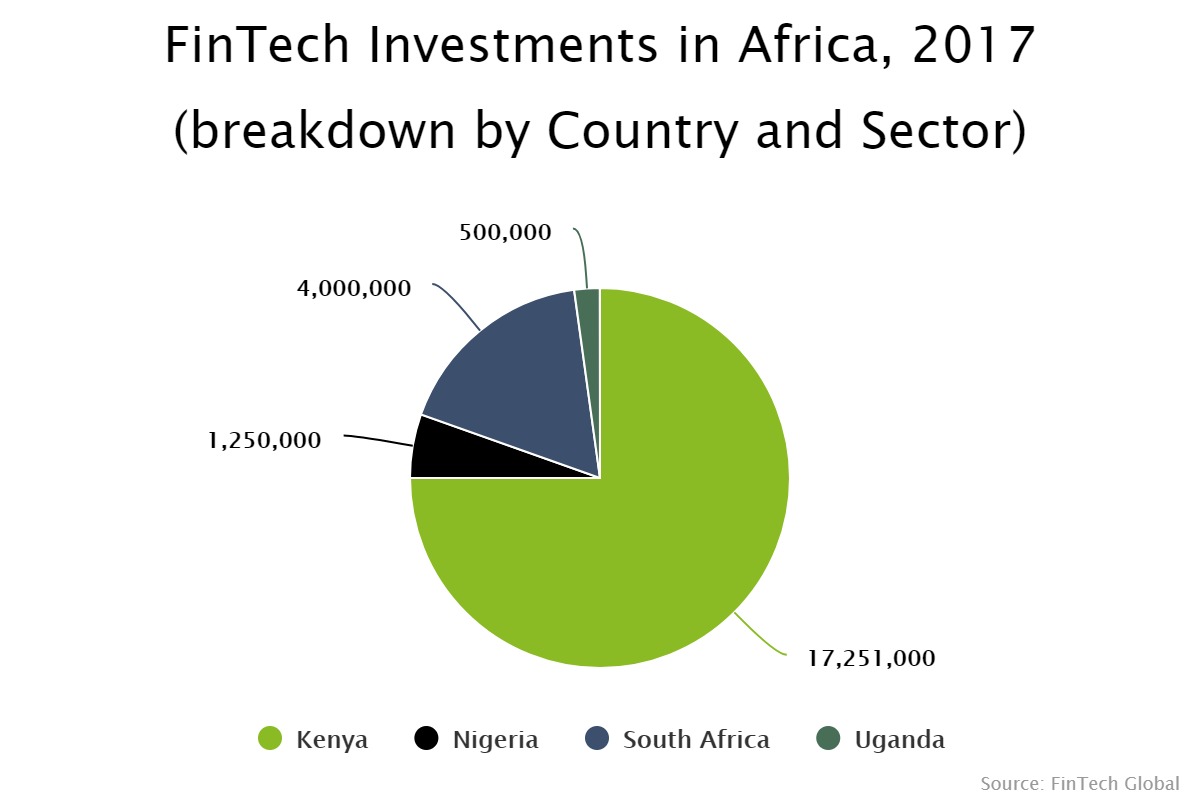

Last year, Kenya FinTech sector received the highest value of funding in Africa, with the country seeing $17.2m invested. The remaining capital was invested in South Africa, Nigeria and Uganda, and combined, amounted to 25 per cent of the total capital invested in Africa.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global