Qwikwire, a cross-border property management company, has closed an undisclosed round of funding.

First Asia Venture Capital and Cerebro Labs led the investment, with participation also coming from investors from the US and Japan.

This investment is Qwikwire’s largest to date, the company said. Previously, the company has raised more than $460,000 from 500 Startups, JFDI, and Manila Angel Investors Network.

Qwikwire provider property developers and brokers with a range of real estate solutions including property management, SAP integrated billing and invoicing systems, cross-border settlements through remittance channels and a blockchain multi-listing platform. The platform enables clients to send bills and invoices through e-mails.

Founded in 2014, the company helps with the monthly amortization, property monitoring and association dues.

The company is looking to launch its AQwire solution, which is a multi-listing platform for brokers and property developers to sell units to foreign buyers.

Next month Qwikwire is looking to launch a pre-ICO and a ICO, with a target of $9.9m. All marketing efforts will be geared towards the crowdsale, the company said.

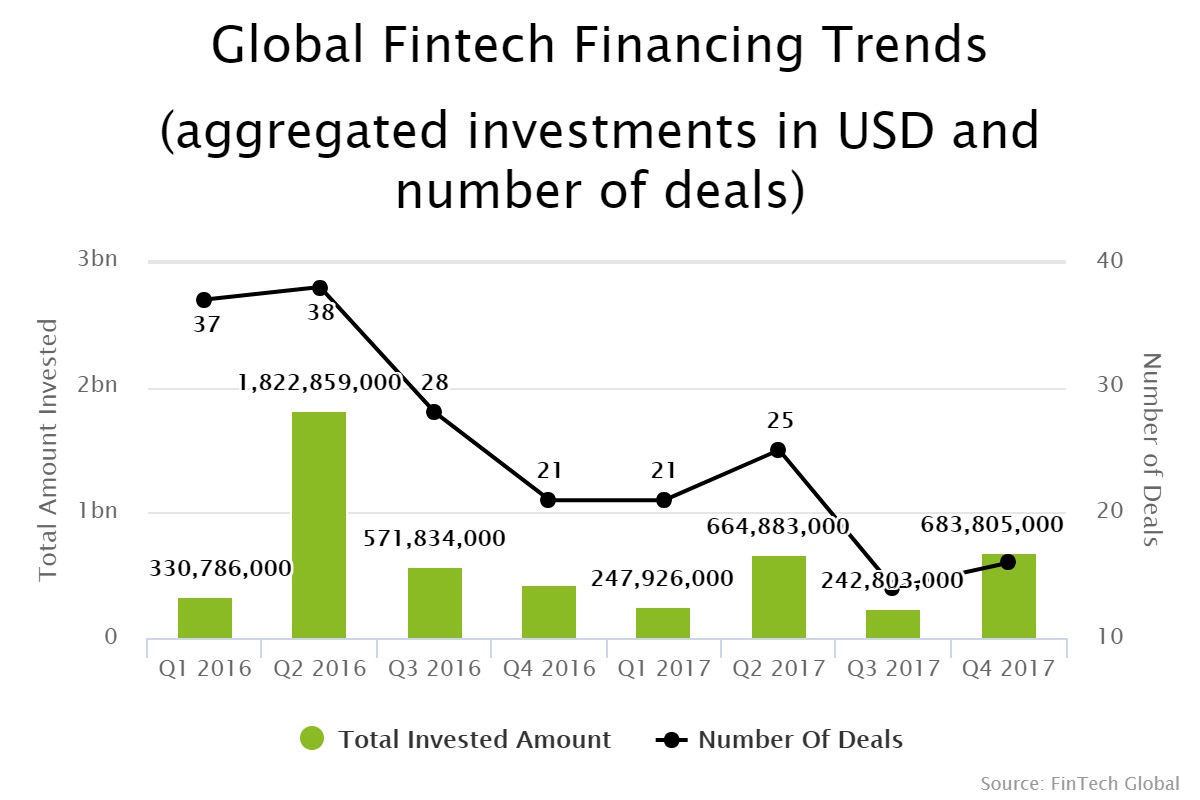

Funding in the global real estate tech sector declined last year, after a strong 2016 for investments. There was $1.8bn less deployed across 2017, compared to 2016 where a total of $3.1bn was invested globally.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global