Aldrich Capital Partners has made a $26m growth investment in to electronic payment provider Paymerang.

This transaction will buy-out company investors and will support the development of new jobs, products, sales channels and operational infrastructure. Virginia-based Paymerang hopes to expand its operations in the Richmond metro area, and add more than 100 jobs over the next five years.

Founded in 2010, the company offers a solution for electronic supplier payment processing, automating processes for accounts payable and accounts receivable teams. Through the technology a client can electronically pay their vendors from a single location and in a secure manner to avoid fraud.

The software handles the entire process from vendor enrolment to payment processing, and payment reconciliation.

Aldrich founding partner Mirza Baig said, “Procure-to-Pay is in the process of disruption and Paymerang is the vehicle to do it. We expect to provide significant operational support to rapidly grow Paymerang through organic and acquisition-based growth. This is a vast market that is still in early innings and we look forward to proving out our investment thesis over the coming years.”

Earlier in the year, fellow procure-to-pay automation platform BirchStreet Systems received a minority investment from Serent Capital. The equity was raised to support its growth strategy as well as furthering its product innovation.

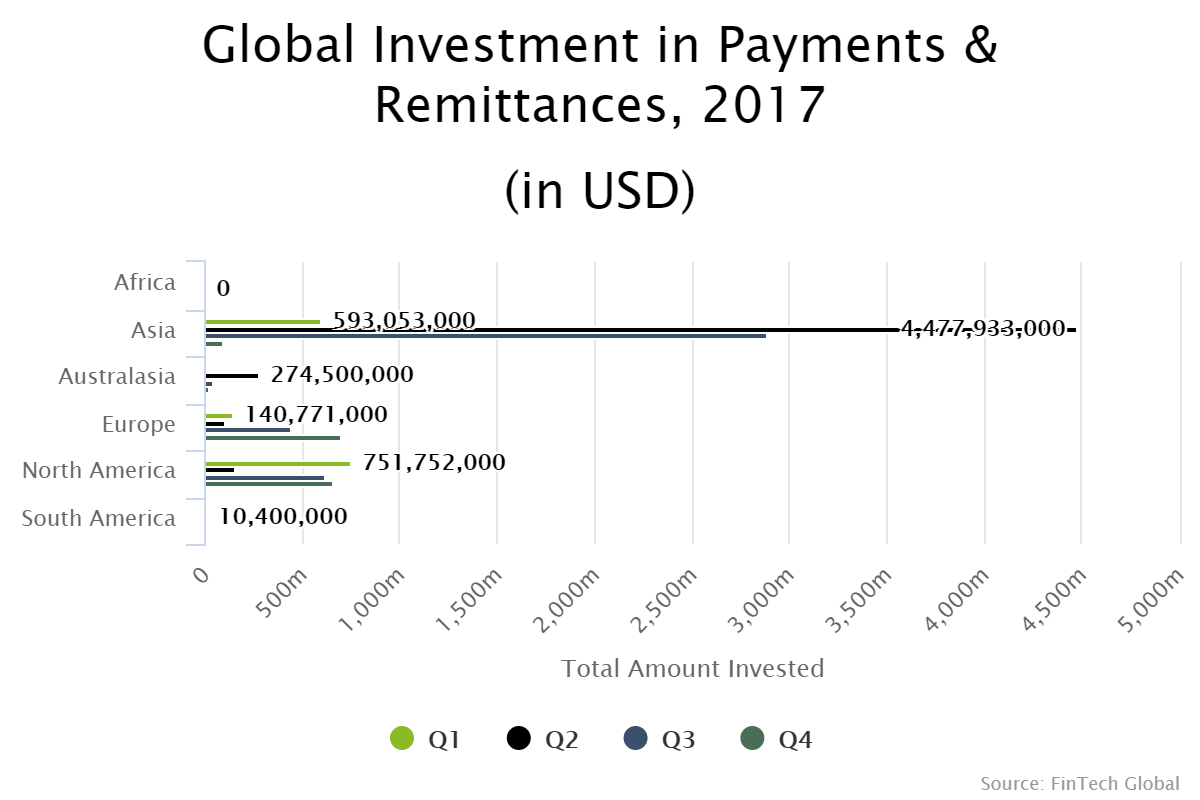

Last year, the payments and remittance sector was dominated by the Asian market, according to data by FinTech Global. Of the total $11.9bn deployed globally, around 67 per cent was invested in companies in Asia.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global