AGM Group Holdings, a trading platform developer for financial institutions, has closed its IPO on $6.53m.

The sale was for 1.3 million Class A ordinary shares at the price of $5.00 a-piece. The company’s Class A ordinary shares are set to trade on the NASDAQ Capital Market under ‘AGMH’.

Founded in 2015, AGM develops trading platform solutions and technology for brokerage firms and financial institutions. The company, headquartered in Beijing, offers three products: an online trading application for institutional clients, a forex trading brokerage service, and a program trading application technology and management service.

Clients are able to trade over 80 products on the platform including currencies, commodities, and precious metal.

Network 1 Financial Securities served as the underwriter for the offering and Ortoli Rosenstadt served as the US legal counsel.

This transaction marks the third Chinese company to close a deal this month. Last week, SenseTime, an AI company that focuses on facial and image recognition technology, closed a $600m Series C funding round. Cryptocurrency trading and data service provider BitKan also recently closed a funding round, picking up $10m in its Series B.

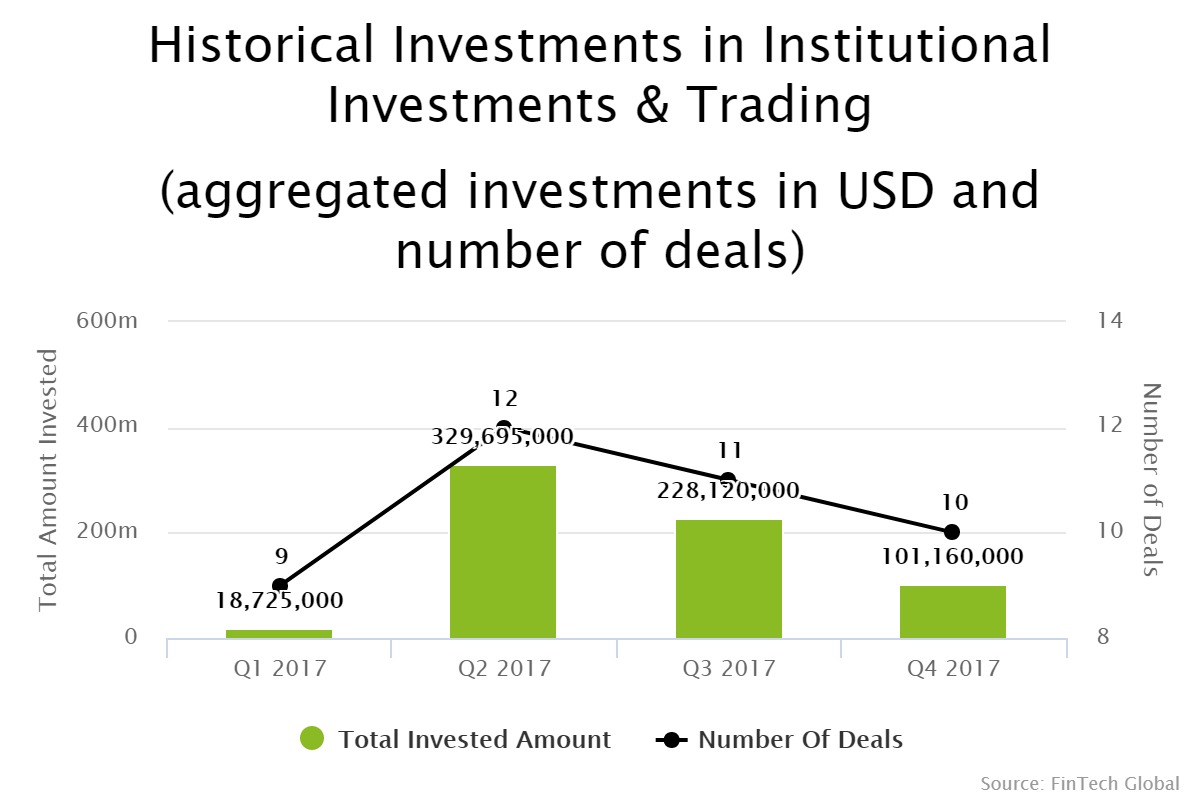

Funding in the institutional investments and trading sector has seen a two-quarter decline since Q2 2017, according to data by FinTech Global. Investment volume has declined by $228m and deal activity has fallen by two between Q2 and Q4.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global