British challenger bank Metro Bank has revealed its AI-powered money management service Insights.

The offering, which was developed with personalised banking solution developer Personetics, will help the bank’s customers manage their finances and meet financial goals. Set to launch in the summer, the product will be available through the app for all personal customers.

By using predictive analytics and AI, Insights can continuously monitor transaction data and patterns in real-time to identify trends and events in users’ spending habit. This information is transformed to prompts to boost control of finances, either by warning about auto-renewing subscriptions, or alerting any unordinary spending activity.

The application will also offer tips and warnings for duplicate and large transactions, low balances, irregular bill amounts, and a detailed purchase analysis.

Metro Bank will look to add more services over the company months.

Personetics co-founder and CEO David Sosna said, “We are excited to work with Metro Bank and be part of the transformation they are bringing to British banking. The revolution in banking starts with putting the customer first, and banks that embrace this path forward will be well-positioned to win customers’ trust and earn their business.”

Earlier in the year, Pesonetics partnered with fellow UK-based challenger bank Tandem to provide new services to the banking app. Tandem integrated its app with Pesonetics to give its customers personalised insights to their spending.

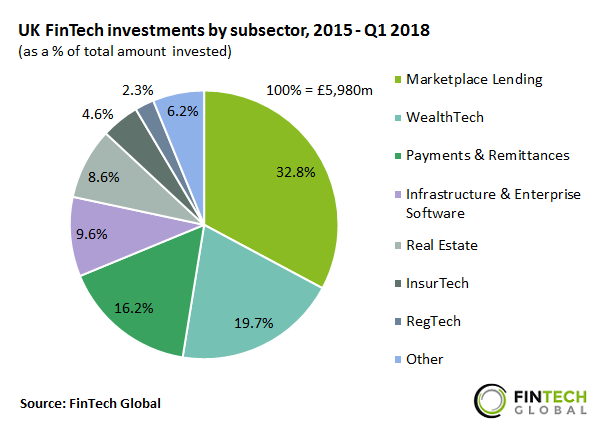

The WealthTech sector represents the second largest FinTech sector in the UK, according to data by FinTech Global. The space has received 19.7 per cent of the total £5.9bn that has been deployed across the UK since 2015.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global