P2P lending platform Funding Societies has raised $25m in its Series B led by SoftBank Ventures Korea.

Funding to the round also came from existing investors Sequoia India, Alpha JWC Ventures (Indonesia) and Golden Gate Ventures, alongside Qualgro and LINE Ventures.

The company also received undisclosed credit lines from banks and financial institutions to further support SMEs.

Founded in 2015, Funding Societies is a digital lending platform that connects SMEs in Singapore, Indonesia, and Malaysia with retail and institutional investors. At the start of the year, the company moved past the SGD $100m ($76m) in crowdfunded SME loans. In the past three years the company has increased its lender base by 60,000.

The platform works by a business applying for working capital, and once Funding Societies has authenticated the request, lenders can commit capital to the loan. The platform implements e-signing of contracts, an auto investing algorithm for lenders, and a mobile-based app.

Equity from the round will be used to help with Funding Societies financial inclusion goal for Southeast Asia.

Golden Gate Ventures managing partner Vinnie Lauria said, “We invest in disruptive technologies. Funding Societies uses machine learning on a large number of data points to identify opportunities that traditional banks would overlook. This leads to smarter financing decisions and higher-quality SMEs on their platform. Their loans are crowdfunded within minutes.”

Funding Societies previous funding round was a $7.4m investment led by Sequoia India in 2016. The company raised the capital to improve its customer experience and to support it with navigating the regulatory environments in Singapore, Malaysia and Indonesia.

Earlier in the year, Softbank invested $400m into Indian banking platform Paytm, alongside a $45m contribution from Alibaba.

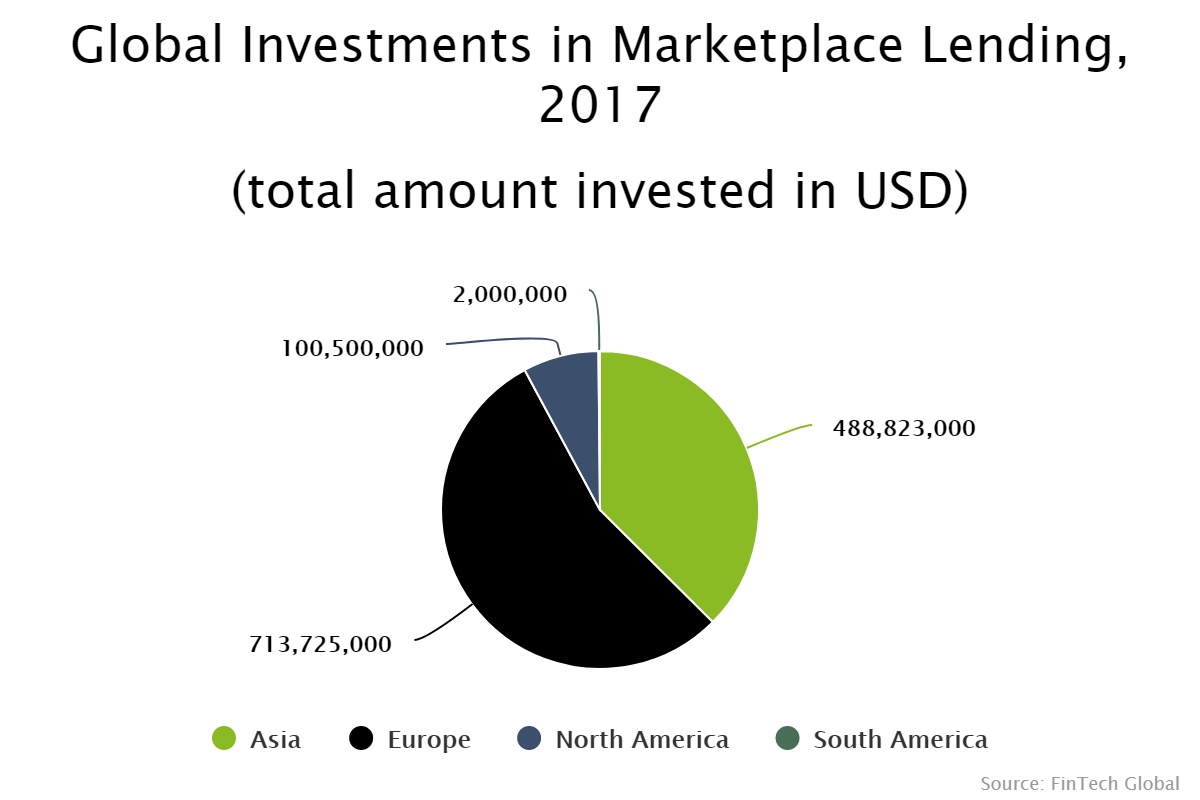

Last year, Europe led the way for funding into P2P lending companies with a 55 per cent share of the total equity deployed, according to data by FinTech Global. Asia represented the next biggest region for investments, bagging around 37 per cent of funds.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global