CVC Credit Partners and the EQT Credit platform have jointly arranged £218m of senior and subordinated financing for Paymentsense for their second round of financing for the company.

The pair previously provided a £110m unitranche facility in late 2016 for Paymentsense, which specialises in providing fast, affordable and reliable card processing services to over 65,000 SME businesses. The company enables businesses to accept payments via card machines, online or through mobile phones.

Chris Fowler, managing director in CVC Credit Partners’ European direct lending business, said, “Companies across the UK are increasingly looking for innovative sources of financing and we are delighted to have been able to support Paymentsense’s growth ambitions for the second time.

“The company has huge growth potential, with a differentiated business model and stellar management team and we are very proud to continue our partnership alongside EQT Credit.”

EQT Partners director Andrew Cleland-Bogle added, “Paymentsense is led by an entrepreneurial and growth-oriented management team, whose stewardship has seen the business rapidly expand its market share. Notably, this impressive organic growth has been without the involvement of a financial sponsor.”

EQT’s credit arm held a final close of its third opportunities vehicle four months ago after collecting €1.3bn. EQT Credit Opportunities III comfortably beat its predecessor, which pulled in €845m in 2013.

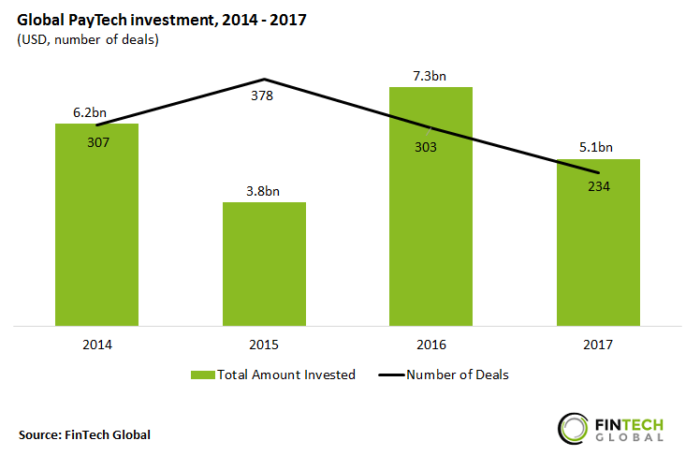

Investments in to the payments and remittances sector saw a significant decline in both funding volume and number of deals, according to data by FinTech Global. PayTech saw a 30 per cent decline in deal activity, while funding fell by $2.2bn.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global