Online lending platform PayMe India has reportedly raised $2m in its angel funding round.

Contributions to the round came from a selection of unnamed investors from Singapore, according to a report by VC Circle. This round includes credit from a group of non-banking financial companies, it said.

PayMe is an online short-term credit provider to support corporate employees. Consumers can take out loans from INR 1,000 ($14.97) to INR 50,000 ($748) for a maximum of 30-day terms.

Credit approval is made after the platform cross-checks the borrower’s social media, credit score, and employment, as well as completing KYC processes. The company also offers load advisory to help borrowers navigate the alternative funding space and improve their financial awareness.

Funds from the round will be used by Pay Me to support the company’s market and capacity expansion, the article states.

There has been a slew of activity in India’s FinTech sector this week, with this marking the fifth deal of the week. Companies to close deals this week include Mircochip payments, Capital Float and Affordplan.

Capital Float is a working capital provider for Indian SMEs and picked up $22m in funding from Amazon. The company offers short-term loans to small businesses to help with purchasing inventory, making new orders and optimising cash cycles.

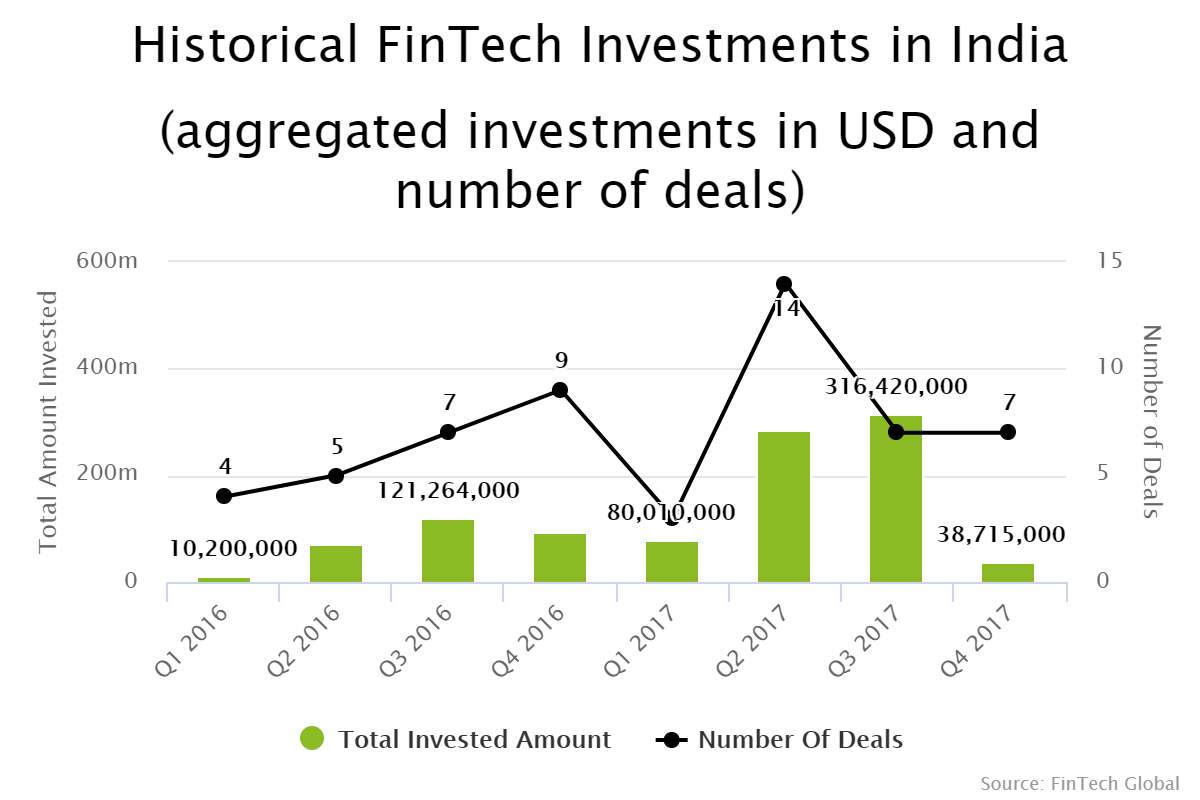

investments into India’s marketplace lending sector increased last year from the $295m invested in 2016, according to data by FinTech Global. Due to a strong second and third quarter last year, the total capital deployed reached $717m.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global