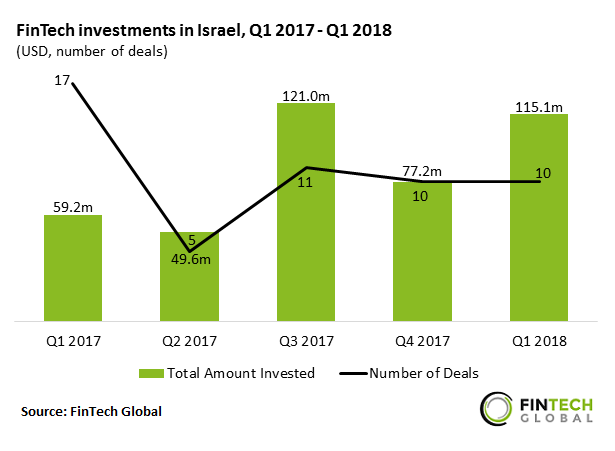

Investment in Israeli FinTech companies was historically healthy in Q1 2018 with $115.1m invested across 10 deals

- The Israeli FinTech had a strong start to the year with capital invested jumping by 49.1% compared to the previous quarter, and doubling YoY.

- Despite the QoQ growth, deal activity remained steady with a mid-range total of ten deals closed.

- The largest deal in Q1 2018 was a $30m investment in BioCatch, a provider of behavioural biometrics for fraud prevention and detection. The Series B round was led by Maverick Ventures Israel with co-investment from NexStar Partners and American Express Ventures, among others. The funding will allow BioCatch to pursue their growth trajectory. This deal accounted for 26.1% of the total amount invested in the opening quarter.

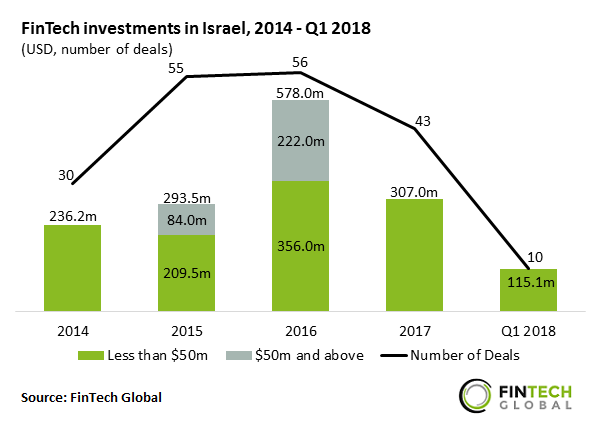

Nearly 40% of the total capital raised last year was invested in Q1 2018

- Both capital invested and deal activity peaked in 2016 when $578m was invested across 56 deals. There were three later-stage deals valued $50m and above during this period, a higher number than in any other year. The largest of these was a $72m Series C investment in OurCrowd, an equity crowdfunding platform, from undisclosed investors.

- Overall investment subsequently dropped by 46.9% in 2017 to $307m. This was largely due to the absence of later-stage deals, although, funding from deals valued under $50m also declined by 13.8%.

- The $115.1m invested in Q1 2018 equates to 37.5% of the total capital raised during the whole of 2017. This puts overall investment on track to surpass 2017’s total.

- Deal activity is on pace with last year’s; the ten deals closed in Q1 2018 represents 23.3% of the total number of deals closed in 2017.

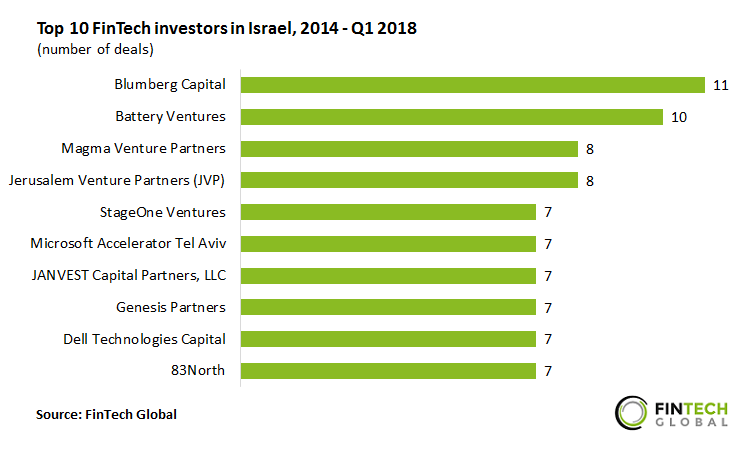

The Israeli FinTech sector relies heavily on domestic sources of capital

- The top ten FinTech investors in Israel since 2014 made a combined total of 79 investments. This equates to 40.7% of all FinTech investments in the country over the same period.

- Of the top ten investors, seven are based in Israel and three in the US. The seven Israel-based investors consist of six venture capital firms and one accelerator, Microsoft Accelerator Tel Aviv.

- Blumberg Capital was the most active investor over this period with 11 deals. The largest of these was a $24m Series C investment in Zooz, a data-driven payments platform, in Q2 2016.

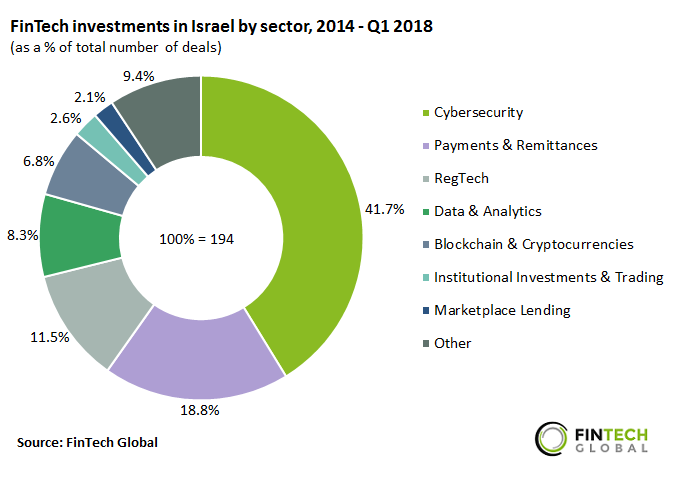

Over 40% of Israeli FinTech investments go to cybersecurity companies

- Cybersecurity companies offering solutions for the financial services industry received the highest share of FinTech deals in Israel between 2014 and Q1 2018 with 41.7%.

- Several factors have contributed to Israel securing its status as a cybersecurity powerhouse in recent years. The technology units of Israel’s compulsory military service are known for producing elite tech talent and entrepreneurs. Additionally, the country has a supportive government, and financial institutions which are particularly adoptive of innovative cybersecurity applications.

- The Payments & Remittances sector followed with a 17.7% share of all deals. The booming cybersecurity industry in Israel naturally ties in with the online payments sector. Israeli companies such as Zooz, Paykey and Payoneer have established themselves as leaders in this field.