Gulf Capital has secured a strategic stake in electronic payment solution provider Saudi Geidea, in a deal worth over one billion Saudi Riyals ($266m).

Founded in 2008, Saudi Geidea is a payments processor which provides portable, countertop, pinpad and self-service terminals. Its solution can also be used to support e-vouchers and loyalty systems, which can be used to give consumers rewards for making transactions.

Saudi Arabia-based Geidea offers a selection of other services including smartphone messaging for customer communication, customer site record keeping, terminal hot swapping.

This transaction comes after the Saudi Arabian Monetary Authority launched a new initiative to promote FinTech in the country and cement it as a hub for innovation.

Gulf Capital managing director Abdullah Shahin said, “Geidea has been driving the transformation of banking and traditional retail towards electronic payment, with the full support of SAMA. The company is striving to drive the transformation towards a society that implements electronic payments rather than cash transactions.

“With this aim, it has developed affordable but high-quality systems and devices. We look forward to working closely with Geidea and to supporting its ambitious growth and regional expansion plans.”

This investment marks the fifth deal by Gulf Capital, which is based in the United Arab Emirates, into a technology company.

Last month, the Saudi Arabian Monetary Authority formed an agreement with blockchain-based payments solution Ripple to support the use of xCurrent by banks in the country.

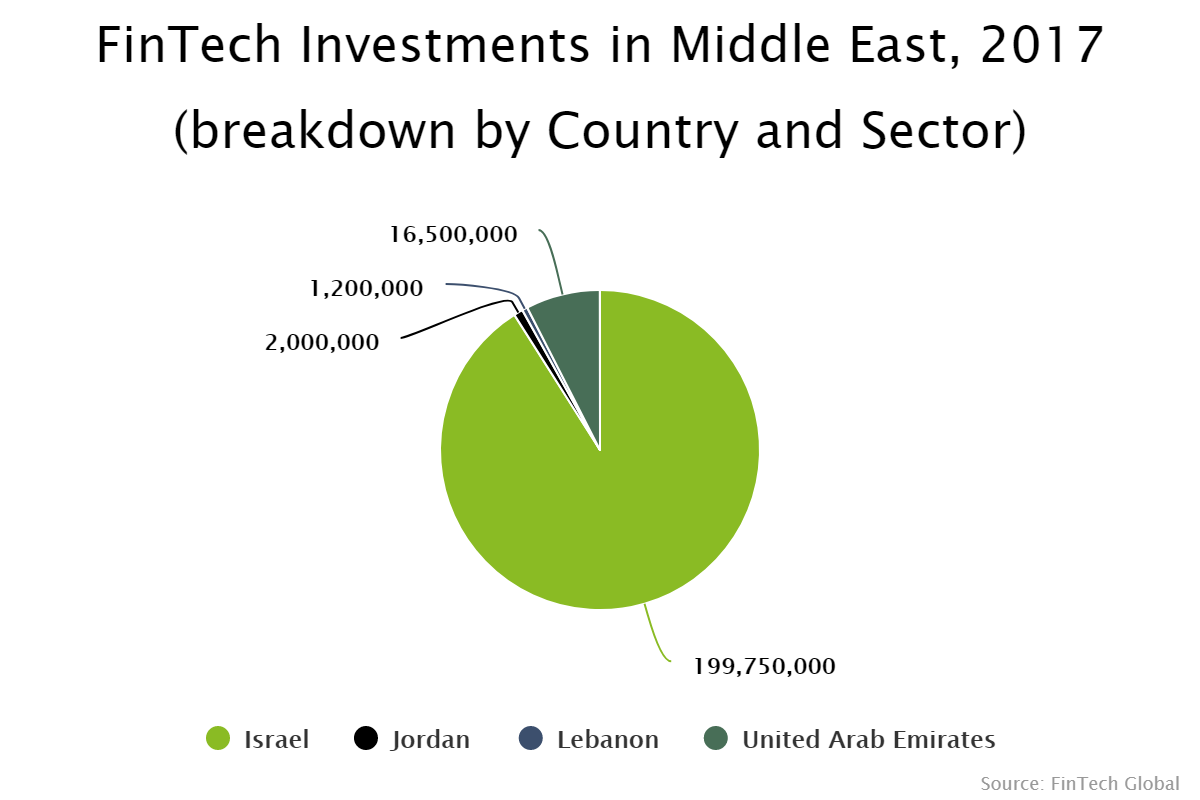

The payments and remittances sector in the Middle East and Israel region was dominated by Israel, which secured $199m of total funding, according to data by FinTech Global. Of the total $218m invested in the region, around 91 per cent of the capital was invested into companies in Israel.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global