Fair Square Financial, which operates the Ollo credit card, has received $100m in funding from The Orogen Group.

Delaware-based Fair Square uses advanced analytics, data and modelling to identify an individual’s level and qualify consumers to credit. Through this technology, the company can provide Ollo customers with personalised and competitive products.

Ollo is a credit card which gives customers a clear and streamlined access to digital servicing and credit financing. There are two products available platinum and rewards. The platinum card offers credit access with no annual fee, no fraud liability, no extra fees, an online FICO score and and automatic credit line increase review.

Its reward card offers 2 per cent cash back on gas station, grocery store and drugstore transactions, and 1 per cent cash back on all other spending.

This capital injection will be used to further its growth plans and add extra flexibility to meet the needs of its rising demand.

Vikram Orogen CEO Pandit said, “The Fair Square team is taking a proven business model and enhancing it with the latest data and machine learning technology to provide credit to middle class Americans through superior underwriting.”

This investment follows its previous $200m funding round it raised in 2016 from private equity firm Pine Brook, which is still the majority investor in Fair.

Pine Brook co-president William Spiegel said, “Fair Square’s combination of credit card industry expertise with advanced analytics has quickly made it the first significant ‘CardTech’ business.”

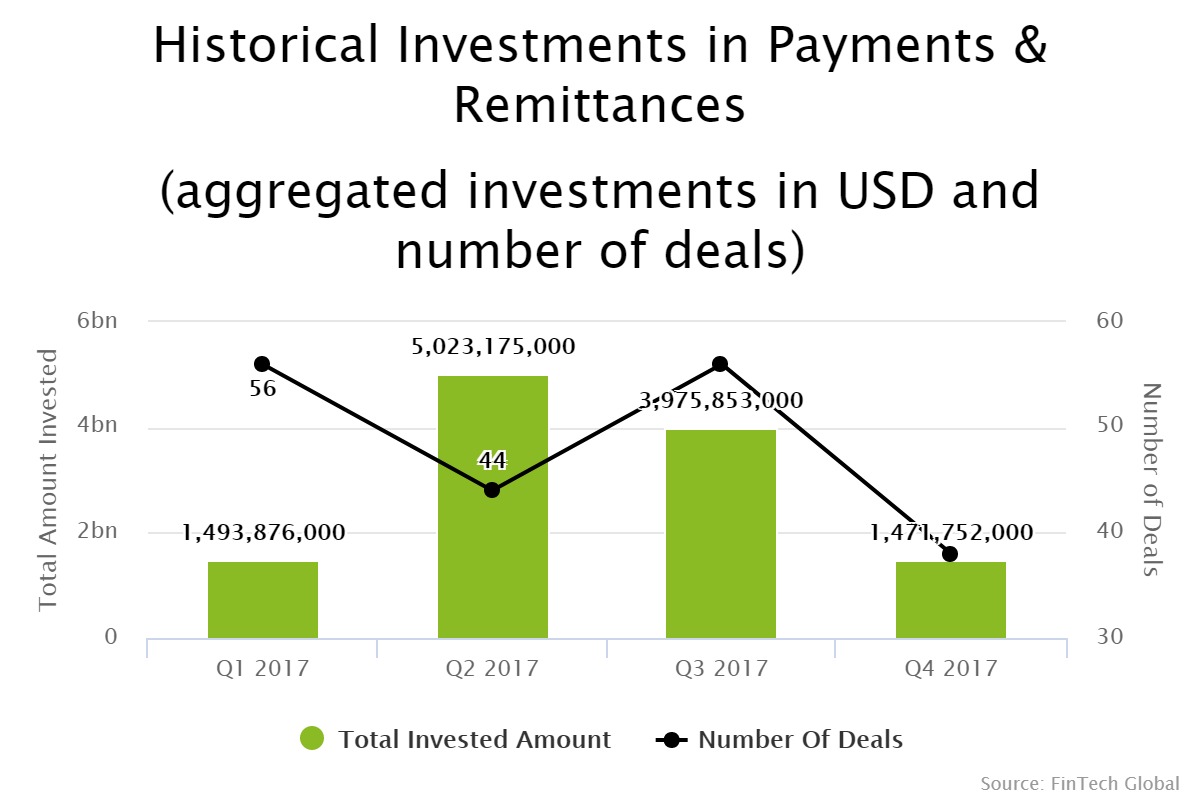

The payments sector saw a two-quarter decline in funding towards the end of last year, according to data by FinTech Global. There was over $1bn more capital invested in H1 2017, compared to the second half, with funding in Q2 nearly equalling the amount raise in the final two-quarters combined.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global