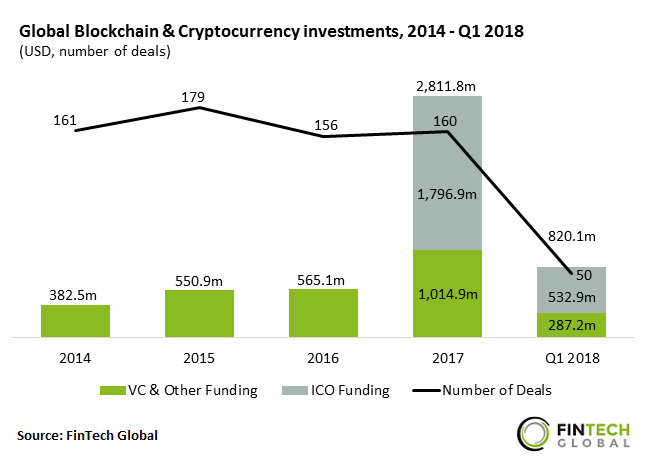

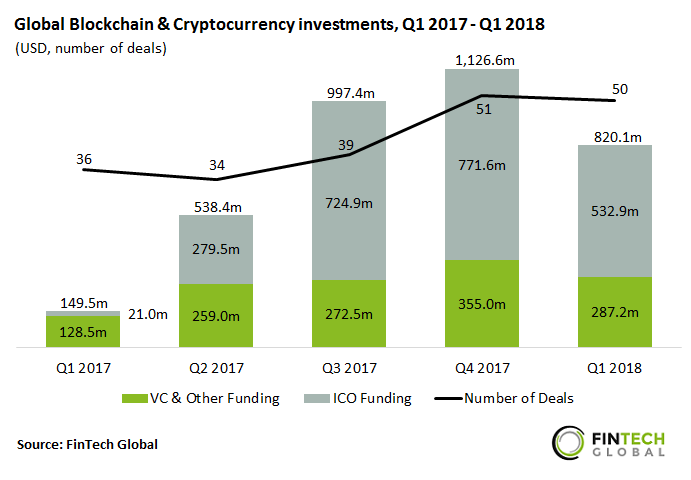

Q1 2018 saw $820.1m invested across 50 deals in the third strongest funding quarter to date

- The increase in popularity of the Blockchain & Cryptocurrencies sector last year resulted in total investment skyrocketing to reach $2.8bn. The $820.1m invested in Q1 equates to 29.2% of last year’s total, meaning funding is on track to beat record levels.

- Since 2017, approximately two thirds of capital invested has been raised through initial coin offerings (ICOs). ICOs can help startups get financing quickly and easily by allowing them to access a wide pool of investors. However, this means of fundraising remains controversial due to the unregulated nature of the market and it is yet to be seen if it is a sustainable way of financing.

- Deal activity is also ahead of pace; the 50 deals completed in Q1 represents 31.3% of the total in 2017.

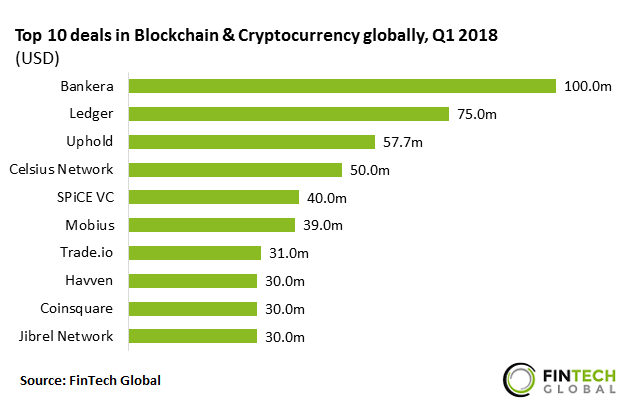

- The largest deal of 2018 so far was a $100m ICO raised by Bankera, a blockchain banking platform, from over 80,000 contributors.

Global Blockchain & Cryptocurrency investments lost steam in Q1 but remain historically high

Although capital invested in Q1 2018 was historically high, there was a drop of 27.2% QoQ.

Although capital invested in Q1 2018 was historically high, there was a drop of 27.2% QoQ.- Q1 2018 saw a decline in the price of many cryptocurrencies from last year’s highs, along with mounting skepticism of the sector. This may have factored in the lower overall investment total compared to the previous two quarters.

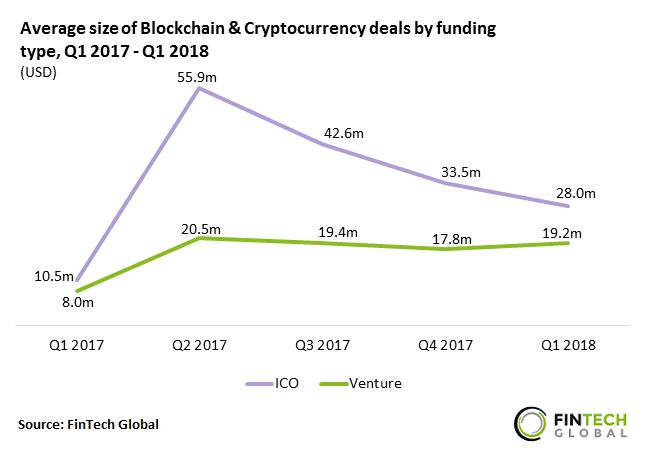

- Capital raised through ICOs has quickly overtaken traditional venture capital funding since its appearance in Q1 2017.

- In terms of deal activity, Q1 2018 was the joint second most active quarter to date with 50 deals completed.

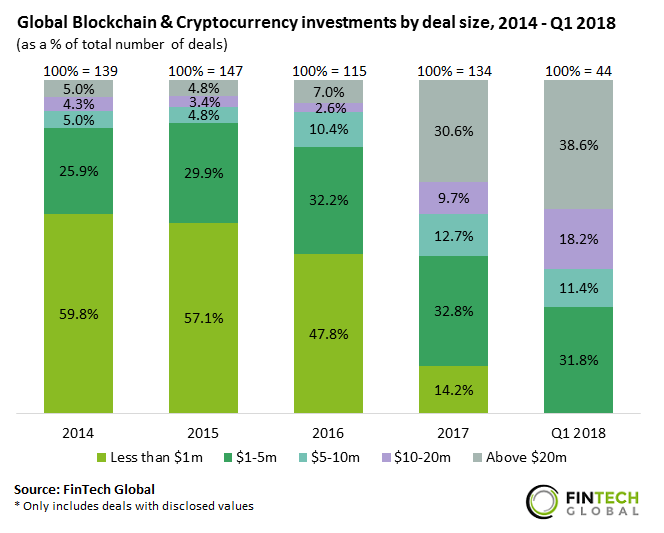

There has been a rapid shift towards larger deals since the introduction of ICOs

- ICOs have consistently raised larger investments on average than traditional venture capital funding rounds by enabling companies to tap into a wider market.

- Since their appearance as a fundraising method in 2017, there has been a rapid increase in the share of large deals. Last year, ICOs accounted for nearly 60% of deals valued over $10m.

- The share of deals valued less than $1m decreased by 33.6 percentage points (pp) between 2016 and 2017, from 47.8% to just 14.2%.

- This fall was largely taken up by deals valued above $20m which increased in share by 4.4x over the same period, from 7% to 30.6%. Similarly, deals valued between $10-20m almost quadrupled in share from 2.6% to 9.7% of the total.

- This trend continued in Q1 2018, when there were no deals valued less than $1m, and those valued above $20m accounted for 38.6% of all deals.

Seven of the top ten investments in Q1 2018 were raised through ICOs

- The top ten deals in Q1 2018 raised a combined total of $482.7m which equates to 58.9% of the total amount invested in the quarter.

- The largest deal was the previously mentioned $100m ICO raised by Bankera. This was followed by a $75m investment in Ledger, a security developer for cryptocurrency and blockchain applications. Its Series B round was led by Draper Esprit with participation from Digital Currency Group and FirstMark Capital, among others.

- A notable deal in the top ten is the $40m ICO raised by SPiCE VC, a cryptocurrency venture capital firm. The firm plans to invest in tokenised and blockchain projects with its cryptocurrency capital pool.

Although capital invested in Q1 2018 was historically high, there was a drop of 27.2% QoQ.

Although capital invested in Q1 2018 was historically high, there was a drop of 27.2% QoQ.