Hong Kong-based Robo-advisor Quantifeed has collected $10m Series B round led by Cathay Financial.

US global asset manager Legg Mason also took part in the round of funding.

Quantifeed is an automated investing platform that helps financial institutions to provide advisors and customers with a digital wealth management service. The robo-advice solution helps customers to build personalised portfolios based on risk assessment, life goals and thematic ideas.

Investing supported by the application include global stocks, funds, ETFs, and mutual funds, as well as other assets classes.

The company currently provides B2B robo-advice to nine financial institutions in Asia including Cathay Financial’s subsidiary Cathay United Bank. Other clients include Jachin Capital and SinoPac Securities (Asia).

Currently, Quantifeed operates in Hong Kong, Taiwan, Malaysia, Singapore and Australia.

This equity injection will enable the company to bolster its regional growth across Asia, as well as the launch of a new office in Singapore. Some of the proceeds will also be funneled towards research and development in behavioural analytics and data science, in order to improve customer experience.

Quantifeed CEO and co-founder Alex Ypsilanti said, “We welcome the commitment of Cathay Financial Holdings and Legg Mason to our growth and we are confident that they will bring enormous value to our business.

“We are bringing about wealthcare, a service aimed at helping everyone make the most of their savings to achieve their financial goals. Our mission is to enable financial institutions transform themselves into providers of this service on a large scale. The additional funding allows us to fulfil this mission.”

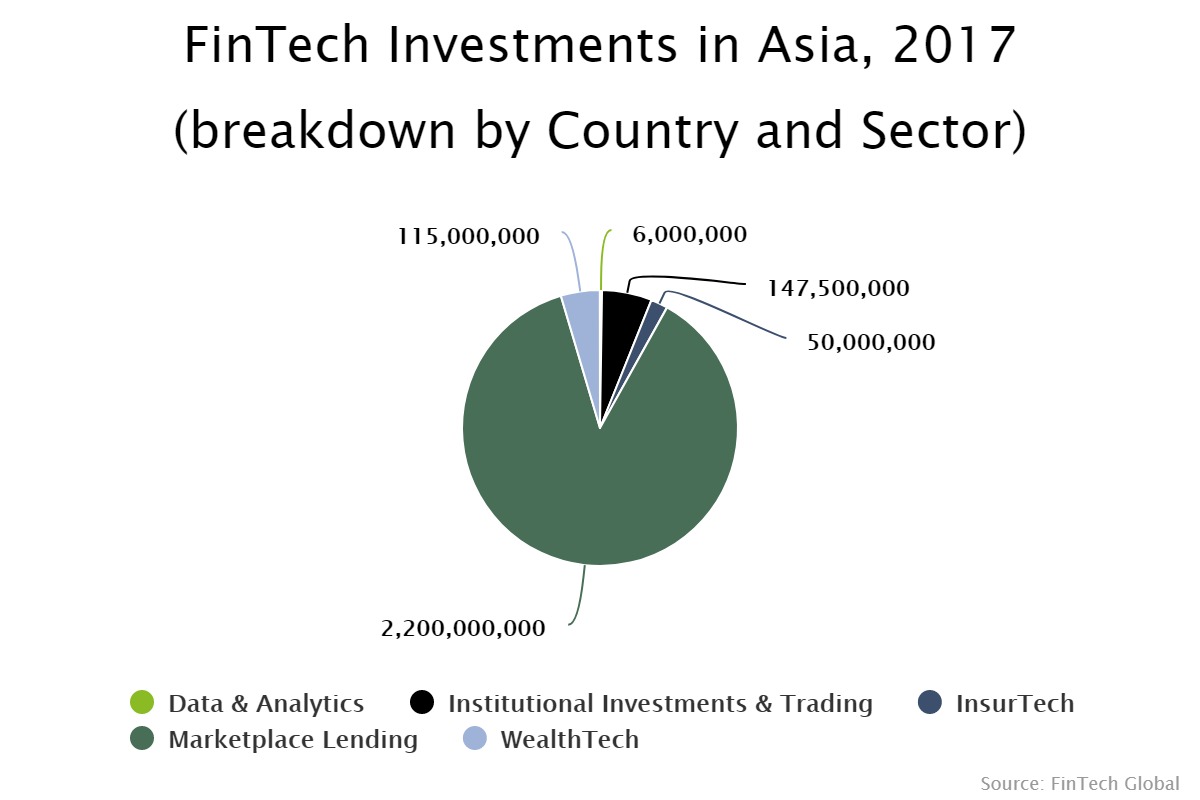

Last year, Hong Kong’s FinTech sector was dominated by marketplace lending companies, in terms of funding volume. According to data by FinTech Global, there was $2.5bn invested into the country in 2017, of which around 88 per cent of the capital went to marketplace lending startups.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global