Kenya-based InsurTech platform Bismart has received an investment from GreenTec Capital.

The company aims to provide consumers across Africa with access to insurance, without the burden of immediate payments, in a transparent and convenient service. Its technology will support the distribution of insurance across the region, helping rapid roll-out and scaling.

Initially, the company will offer a limited range of services and products, which it will then expand. Insurance policies available are for health, seniors, family, motor and life insurance.

This solution will utilise blockchain technology and smart contracts to facilitate policy management and gain security of decentralised databases.

GreenTec CEO Erick Yong said, “One of the biggest challenges for innovative startups in Africa is the implementation of solutions with distribution channels that have Pan-African reach. Bismart’s application of emerging technologies solves this problem brilliantly, while disrupting the insurance value chain from customer acquisition to risk management.”

Through a previous investment from an unnamed backer, the company has been able to develop its platform and its set to launching its services by the start of Q4 2018.

There has been a handful of investments into the Kenya FinTech space this year. Most recently, African digital payment provider Cellulant raised $47.5m in its Series C round, which was led by The Rise Fund.

The company, which debuted its services Kenya and Nigeria, provides consumers and businesses in Africa with a means to complete transactions.

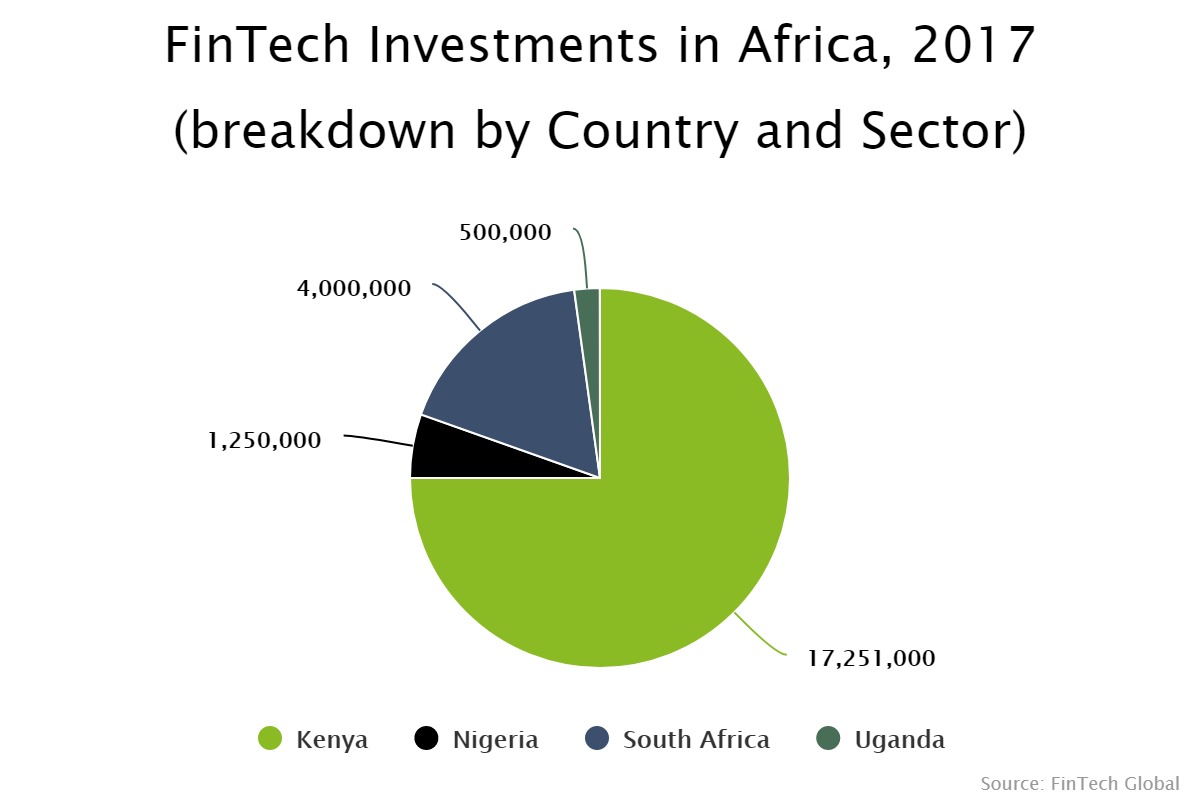

Last year, Kenya’s FinTech space received the lion share of funding in Africa, representing three quarters of the total capital deployed, according to data by FinTech Global.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global