The global FinTech sector raised $41.7bn in the first half of 2018, surpassing last year’s record total

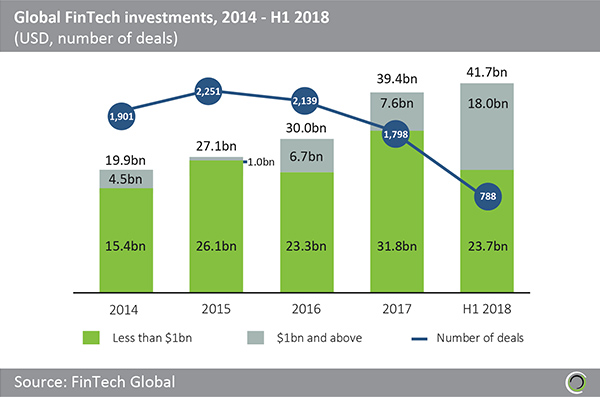

- Global FinTech investments increased steadily between 2014 and 2017 from $19.9bn to $39.4bn at a CAGR of 18.5%. This trend accelerated in the first half of 2018 when $41.7bn was invested across 789 deals.

- There were two megadeals valued above $1bn in the first half of the year including a mammoth $14bn investment in Ant Financial, the payments affiliate of China’s Alibaba Group. The Series C round was led by Temasek Holdings and GIC with co-investment from Sequoia Capital and Warburg Pincus, among others. This single deal accounted for a third of the total capital raised during H1.

- Deal activity peaked in 2015 at 2,251 deals, and has been declining since. This downtrend is set to continue in 2018, with the 789 deals completed equating to just 43.9% of last year’s total.

Investments skyrocketed in Q2 to set a new quarterly funding record

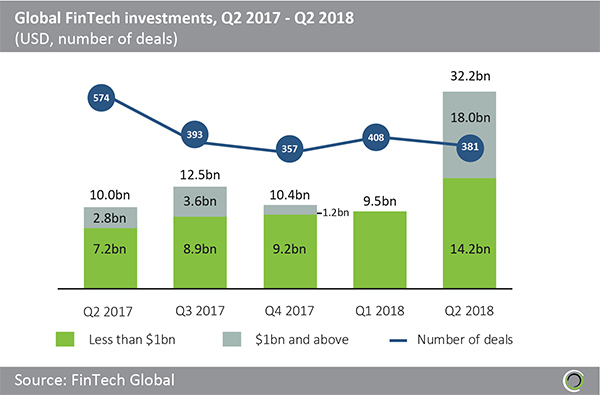

- Capital raised in Q2 2018 surged to reach a record of $32.2bn. This represents an increase of 3.2x compared to the same quarter last year.

- Even when the two megadeals valued over $1bn are disregarded, Q2 2018 still remains the strongest funding quarter to date.

- Despite the high funding total, deal activity was historically low at just 381 deals. This is the second lowest value recorded between 2014 and Q2 2018.

- This resulted in the average deal size, excluding megadeals, jumping from $26.5m in Q1 2018 to $41.5m in Q2.

The global FinTech industry is maturing rapidly

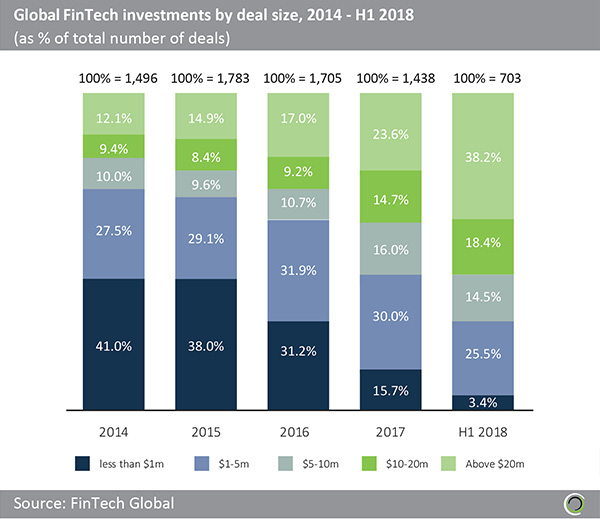

- There was a significant shift towards larger investments between 2014 and 2017. Deals valued below $1m decreased in share from 41% to 15.7% over this period. This trend continued in H1 2018 when just 3.4% of all deals were in the sub-$1m category.

- Conversely, deals valued above $20m increased in share from 12.1% in 2014 to 23.6% in 2017. In the first half of 2018, this figure jumped to 38.3%.

- This pattern of fewer, larger deals indicates that the global FinTech market is maturing at a fast pace.

- Notably, the Marketplace Lending sector has the lowest proportion of deals valued less than $1m at 20.4%. It also has the highest proportion of large deals, with a third of all investments in the sector valued above $20m.

The top 10 FinTech deals in H1 raised almost $22bn

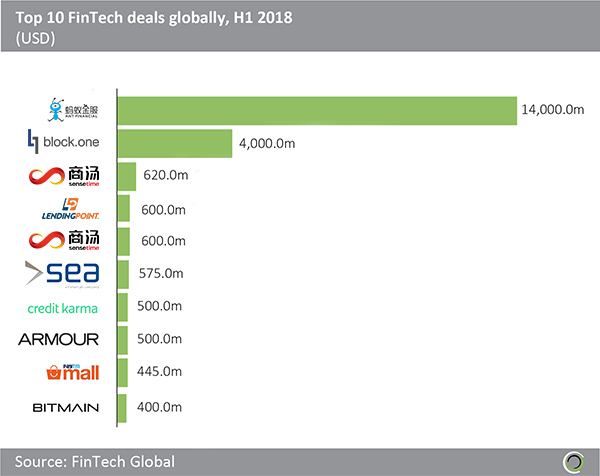

- The aggregate of the top 10 FinTech deals in the first half of 2018 is $21.8bn which equates to 52.3% the total capital raised during this period.

- The largest deal in H1 2018 was the previously mentioned $14bn investment in Ant Financial. This was followed by a $4bn funding round raised by Block.one, an end-to-end blockchain solutions provider, in the largest initial coin offering (ICO) to date.

- SenseTime, a Beijing-based provider of facial recognition technology, features twice in the top 10. The company initially raised $600m in a Series C round led by Alibaba Group. This was followed by a further $620 in Series C+ funding, led by Tiger Global Management, Silver Lake Partners, Fidelity International and HOPU. The funding will be used towards research and development, as well as hiring talented researchers.