Blockchain-based banking startup BABB (Bank Account Based Blockchain) has expanded its team with the hire of banking tech veteran Paul Johnson.

Johnson, the former CIO of UK-based challenger bank Aldermore Bank, has been appointed CIO and will spearhead the world’s first decentralised bank.  During his time at Aldermore, Johnson oversaw the bank’s IPO in 2015 and led its asset expansion over his four-year stint.

Johnson is also an Independent Non-Executive Director at Sonali Bank, a commercial bank in Bangladesh and the largest bank in the country.

In his new role he will work to ensure BABB is fully technically compliant with all relevant UK banking laws as the project works towards obtaining a full UK banking license.

Rushd Averroes, founder and CEO of BABB, said: “We know that regulators would appreciate Paul’s experience from the existing banking community and we’re grateful to have him on board to help us navigate the complexities of UK fiscal and regulatory policy. While blockchain is not entirely unregulated, it is how we will use a blockchain database that will impact regulation.â€

Our decentralised banking platform will enable anyone to open a bank account and crowdsource financial services. BABB is developing a decentralised bank powered, leveraging blockchain, AI, and biometrics technologies to enable anyone in the world access to a bank account for peer-to-peer financial services.

It will use smart contracts on consortium blockchain, machine learning, artificial intelligence (AI) and biometrics to create a next-generation banking solution. Users will be able to interact other users around the world, while its mobile app will make it easy to send, receive, lend and borrow money across borders and exchange currencies, all in a peer-to-peer manner with no middlemen.

“I can only see blockchain technology as the next step in the evolution of payments and asset transfer in the future. The BABB proposition highlights this extremely well with the ‘everyone is a bank concept’ and I am excited to be joining the team to build this platform,†said Johnson added.

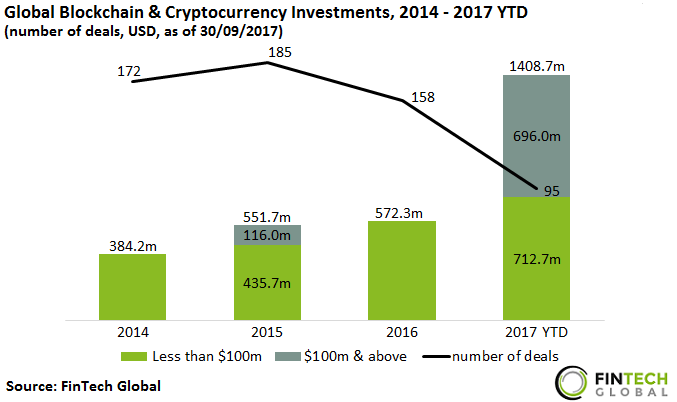

Blockchain & Cryptocurrency investments have nearly tripled last year according to data by Fintech Global. Companies in the sector received $1.4bn in the first three quarters of 2017, more than double the total investment in 2016.

Copyright © 2018 FinTech Global