China-based personal finance business X Financial has launched its IPO for a total offering size of around $104.5m.

The listing is on the New York Stock Exchange and will see 11 million American Depositary Shares with each representing two Class A ordinary shares at $9.50 apiece.

Deutsche Bank Securities and Morgan Stanley are joint book runners for the listing.

Underwriters for the IPO have the option, exercisable within 30 days of the final prospectus, to buy up to 1.6 million additional shares.

X Financial is a personal finance platform which helps undeserved prime borrowers and affluent investors in China. Its risk management software helps match loan requests with investors to help accelerate access to funding for borrowers.

Its data-driven technology, credit analysis and credit insurance (supplied by ZhongAn) improves security on loans.

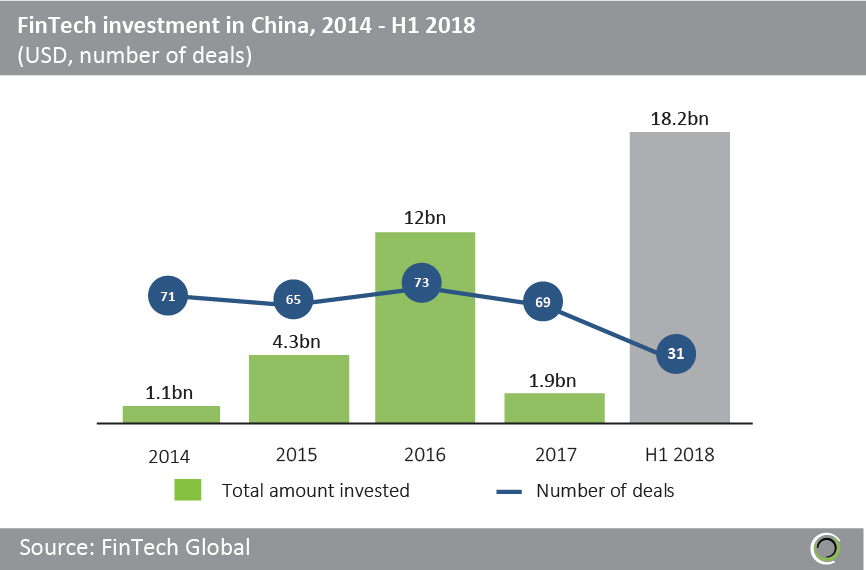

China FinTech market has seen an immense increase in funding over the past year, with its nearly 10-fold compared to 2017, according to data by FinTech Global. In just the first half of 2018 there was $18.2bn deployed to FinTechs based in the country, in stark contrast to the whole of last year which saw just $1.9bn deployed.

Last month, China-based online investment platform Snowball Finance raised a $120m Series D investment to support its trading services. The company operates across four separate investment types which are a stock exchange, investment into Hong Kong and US stocks, fund investment and private placement.

Last month, China-based online investment platform Snowball Finance raised a $120m Series D investment to support its trading services. The company operates across four separate investment types which are a stock exchange, investment into Hong Kong and US stocks, fund investment and private placement.

A number of investors have looked to capitalised on the growing opportunities by closing new funds. It was reported earlier in the week that GSR Ventures closed its sixth vehicle on $400m to invest in technology startups in the country.

Copyright ? 2018 FinTech Global